3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

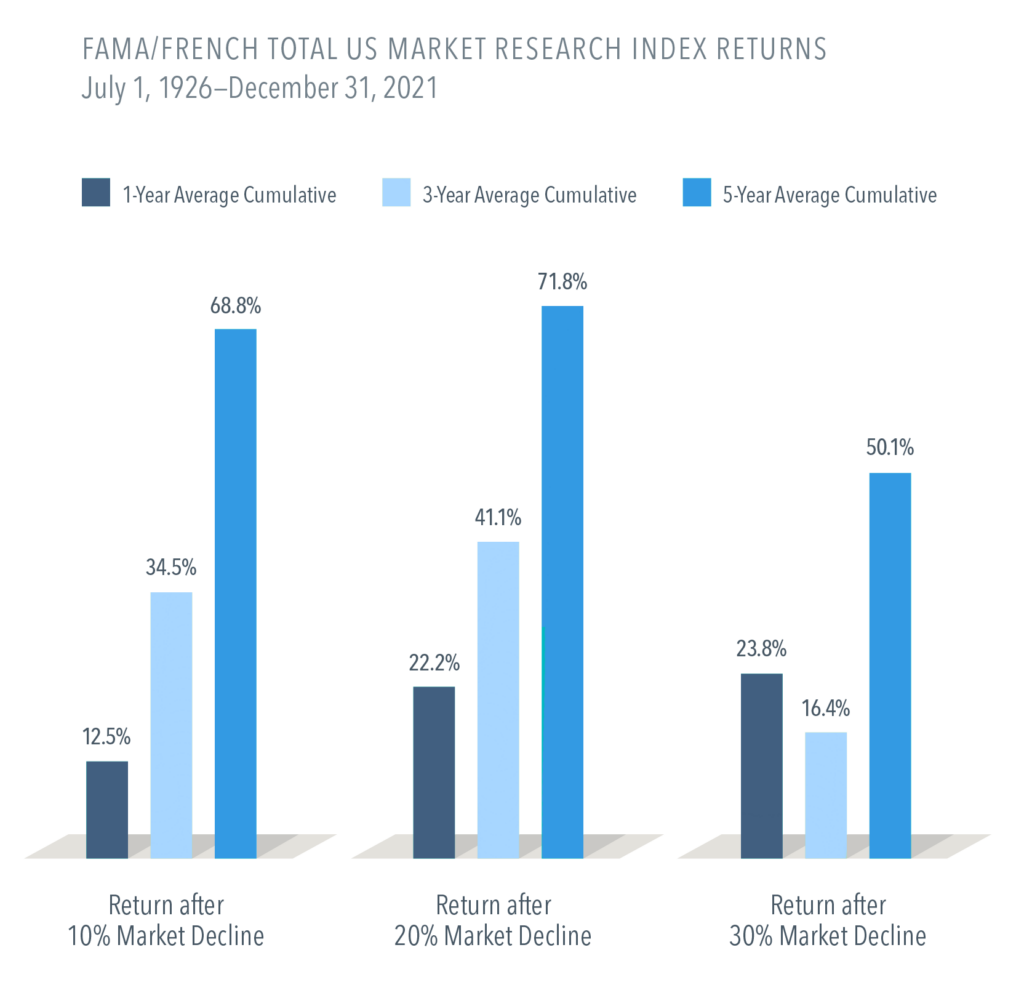

Sticking with your plan helps put you in the best position to capture the recovery.

Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results.

Market declines or downturns are defined as periods in which the cumulative return from a peak is –10%, –20%, or –30% or lower. Returns are calculated for the 1-, 3-, and 5-year look-ahead periods beginning the day after the respective downturn thresholds of –10%, –20%, or –30% are exceeded. The bar chart shows the average returns for the 1-, 3-, and 5-year periods following the 10%, 20%, and 30% thresholds. For the 10% threshold, there are 29 observations for 1-year look-ahead, 28 observations for 3-year look-ahead, and 27 observations for 5-year look-ahead. For the 20% threshold, there are 15 observations for 1-year look-ahead, 14 observations for 3-year look-ahead, and 13 observations for 5-year look-ahead. For the 30% threshold, there are 7 observations for 1-year look-ahead, 6 observations for 3-year look-ahead, and 6 observations for 5-year look-ahead. Peak is a new all-time high prior to a downturn. Data provided by Fama/French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Results shown during periods prior to each index’s index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Back-tested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Back-tested performance results assume the reinvestment of dividends and capital gains.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, LLC To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

Beaird Harris is pleased to welcome three new partners: Nathan Biggs, Matt Edrington and Matt Skinner, to its public accounting practice, signifying the Firm’s continued…

Beaird Harris Named to Dallas Business Journal’s 2024 List of “Top 100 Money Managers.”

We’ll help you get started and learn more about Beaird Harris.