3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

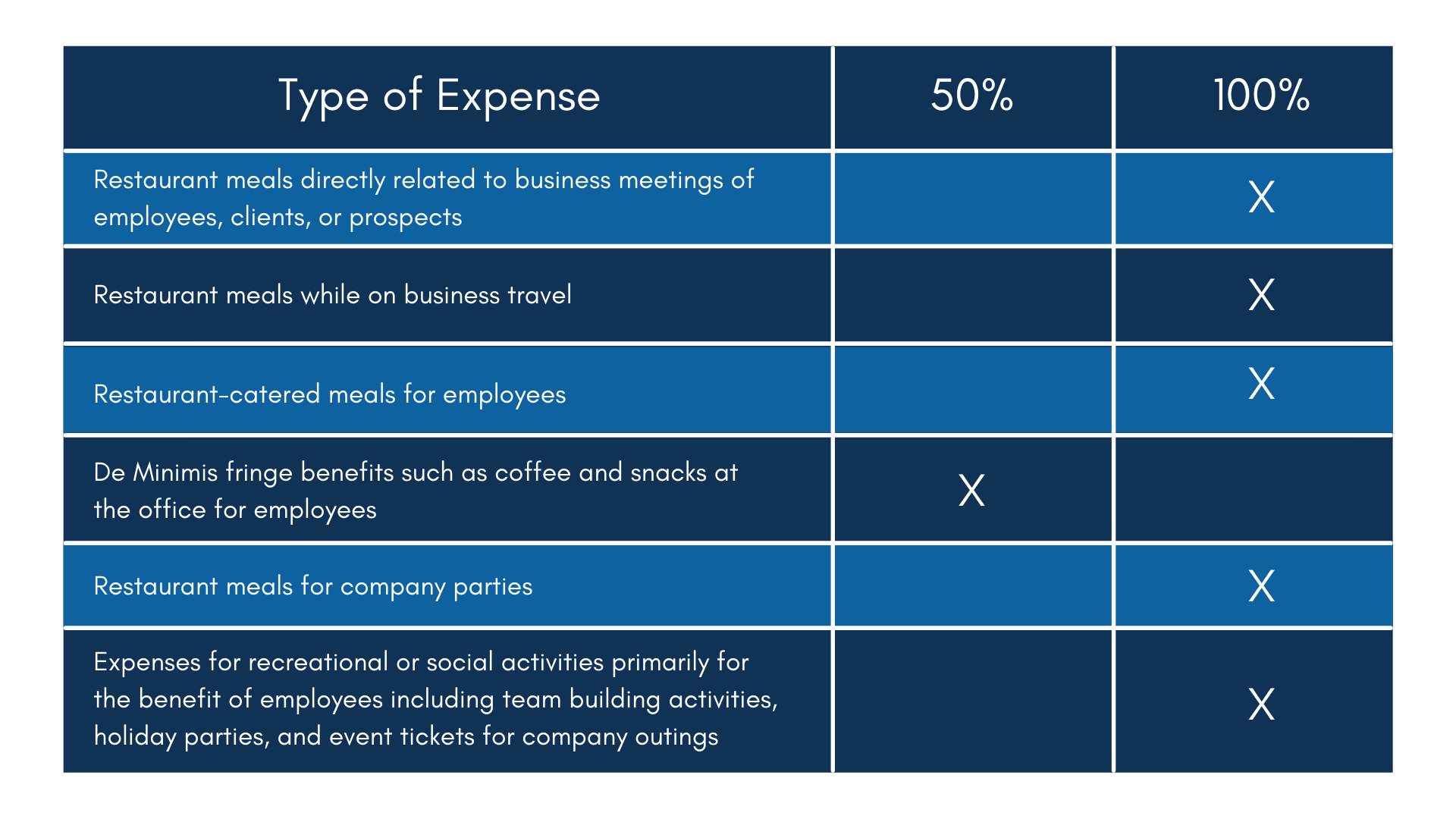

The Consolidated Appropriations Act, 2021 is a spending bill for the COVID-19 pandemic that is making impactful changes on the deductibility of business meals. Any meal expenses purchased from a restaurant after December 31, 2020 through December 31, 2022 are now 100% deductible. This provision was added to the bill with the aim to assist the struggling restaurant industry as a result of the pandemic.

It is important to note that this deduction is only applicable when the meals are provided by a restaurant and still does not apply to entertainment expenses, which may include tickets to sporting events or concerts.

However, any food or beverages including alcohol purchased for a client separately while entertaining is deductible. For example, if you attended a baseball game with a client the tickets would not be deductible, but a meal purchased while there, if paid separately, would qualify as deductible if receipts prove the cost was separate from the entertainment expense.

The one exception to entertainment expenses activities is for your own company/employee events such as holiday parties, firm outings, or team-building events. Because of the different applications of the tax bill, we recommend keeping separate accounts for employee functions, non-employee entertainment, and meal expenses.

Common examples of deductible meals include: The other existing requirements for deductible meals still apply including:

The other existing requirements for deductible meals still apply including:

As always, it is important to keep record of your receipts, attendee’s names, business, and dates in the event of an audit from the IRS.

Please call if you have any questions regarding new meal deductible provisions.

No Professional Advice, Client Relationship, or Reliance on Information

Please note that any information or content on our Website, or any forms or tools on our Website which allow you to submit information or make calculations, and your use thereof, are not intended to provide any kind of professional advice, consultation or service, including but not limited to, legal, accounting, tax, or business advice. Nor does any such information, content, forms, or tools, or your use thereof or reliance thereon, create or constitute an attorney/client, accountant/client, or consultant/client relationship. You should therefore not use our Website or reliance on any information, content, forms, or tools on our Website as a substitute for any kind of professional advice. Rather, you should consult with a licensed professional, including one employed by our Company, for any accounting or tax questions you may have. You agree that we will not be liable to you or to any third party to the extent you treat or consider any information, content, forms, or tools on our Website as constituting any kind of professional advice. The information and content, including but not limited to forms and tools, presented on or made available through our Website are made available solely for general information purposes. We, therefore, do not warrant the accuracy, completeness or usefulness of any such information, content, forms, or tools, and any reliance you place on the same is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to our Website, or by anyone who may be informed of any of its content.

Our Website provides illustrative lists of services that we provide. Nothing contained on our Website shall be construed as an offer or guarantee to provide any particular services to you, nor shall anything on our Website be construed as a direct solicitation for employment by any persons, companies, or organizations. Prior results we have obtained for others do not guarantee a similar outcome.

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

Beaird Harris is pleased to welcome three new partners: Nathan Biggs, Matt Edrington and Matt Skinner, to its public accounting practice, signifying the Firm’s continued…

Beaird Harris Named to Dallas Business Journal’s 2024 List of “Top 100 Money Managers.”

We’ll help you get started and learn more about Beaird Harris.