3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

It’s official; we’ve hit a bear market in 2 of the 3 major U.S. stock indices eclipsing -20% from the previous highs (S&P 500 & Nasdaq). If you watch or read the news, you have undoubtedly seen the frightening headlines. The constant barrage of new headline news is very effective at creating anxiety and many people struggle to separate their emotions from investing. It’s important to remember that markets go up and down and reacting to current market conditions can lead to poor investment decisions. When headlines unsettle you, remember to focus on what you can control and maintain a long-term perspective.

Downturns are Normal

On average since 1926, stocks have dipped into bear market territory every 6 years with losses averaging almost 40%. While market downturns may be unsettling, the financial markets have rewarded long-term investors. Historically, the equity markets have recovered and hit new highs following every major market downturn.

Think back to March 2020, the S&P 500 Index declined 34% from its previous high as the pandemic worsened. Even if investors were able to successfully time getting out of the market, they were probably unable to correctly time getting back in. As more information became available, the S&P 500 Index jumped 18% from its March 23rd low in just three trading sessions. Investors who fled to cash would have missed the rebound!

Don’t Try to Outguess the Market

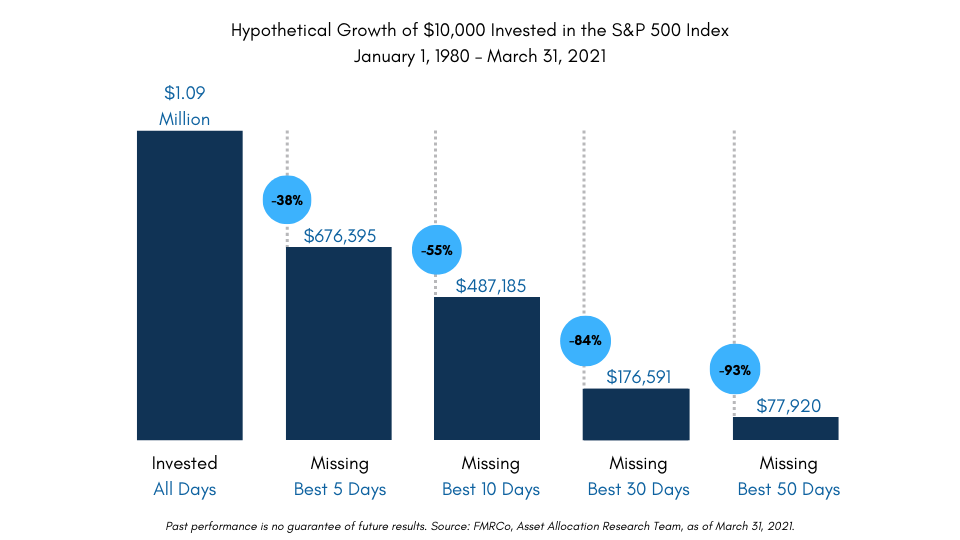

It can be tempting to try and avoid a market downturn by selling out of stocks, but it’s hard to time it right. If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. Missing even a few of the best days in the market can significantly undermine your performance. As shown below, missing out on the best days can be costly:

History is On Your Side

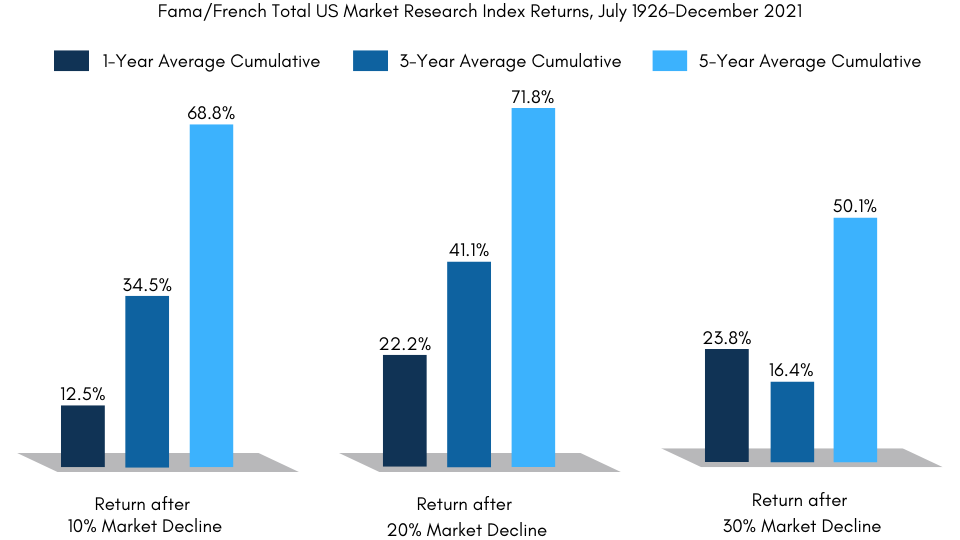

Some of the best times to buy stocks have been when things have seemed the worst. Sudden market downturns are unsettling, but historically, US Stock returns following sharp declines have, on average, been positive. Since 1926, US stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines, making the case for investors to stay the course. Handsome rebounds, such as these, can help put investors in a position to capture the long-term benefits the market offers.

Conclusion

Times of uncertainty and volatility also brings opportunity. We are actively evaluating our portfolios for rebalancing and tax-loss harvesting opportunities. Rebalancing during periods of market volatility helps ensure your asset allocation remains on target. And tax-loss harvesting allows us to lower your tax bill by selling losses to cover realized or future gains. We know these are uncertain times and believe that a balanced and well-diversified portfolio, coupled with a disciplined investment strategy will produce success in the long run. If the recent market volatility has you feeling anxious, please reach out to your advisor – it’s often the case that the current environment has less impact than you might think!

Required Disclosures: PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Short-term performance results should be considered in connection with longer-term performance results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC -“Beaird Harris”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris.

Please remember that if you are a Beaird Harris client, it remains your responsibility to advise Beaird Harris, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Beaird Harris’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request.

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

Beaird Harris is pleased to welcome three new partners: Nathan Biggs, Matt Edrington and Matt Skinner, to its public accounting practice, signifying the Firm’s continued…

Beaird Harris Named to Dallas Business Journal’s 2024 List of “Top 100 Money Managers.”

We’ll help you get started and learn more about Beaird Harris.