Thinking About Selling Your Healthcare Practice? Read This First.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Some investors favor a dollar-cost averaging (“DCA”) approach to deploying their investment capital. Unlike lump-sum investing, in which the full amount of available capital is invested up front, DCA spreads out investment contributions using installments over time. The appeal of DCA is the perception that it helps investors “diversify” the cost of entry into the market, buying shares at prices that fall somewhere between the highs and lows of a fluctuating market. So what are the implications of DCA for investors aiming to generate long-term wealth?

Let’s take the hypothetical example of an investor with $12,000 in cash earmarked for investment in stocks. Instead of buying $12,000 in stocks today, an investor going the DCA route buys $1,000 worth of stocks each month for the next 12 months. If the market increases in value each month during this period, the DCA investor will pay a higher price on average than if investing all up front. If the market decreases steadily over the next 12 months, the opposite will be true.

While investors may focus on the prices paid for these installments, it’s important to remember that, unlike with the lump-sum approach, a meaningful portion of the investor’s capital is remaining in cash rather than gaining exposure to the stock market. During the process of capital deployment in this hypothetical example, half of the investable assets on average are forfeiting the higher expected returns of the stock market. For investors with the goal of accumulating wealth, this is potentially a big opportunity cost.

Despite the drawbacks of dollar-cost averaging, some may be hesitant to plunk down all their investable money at once. If markets have recently hit all-time highs, investors may wonder whether they have already missed the best returns and so ought to wait for a pullback before getting into the market. Conversely, if stocks have just fallen and news reports suggest more declines could be on the way, some investors might take that as a signal waiting to buy is the wiser course. Driving the similar reactions to these very different scenarios is one fear: what if I make an investment today and the price goes down tomorrow?

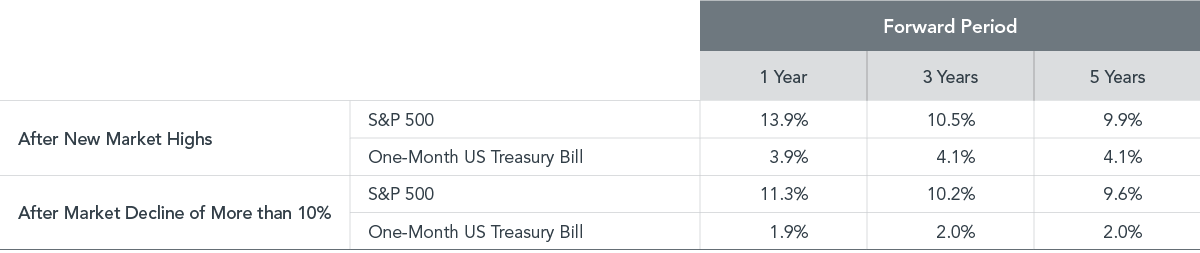

Exhibit 1 puts those fears in a broader context. It shows the average annualized compound returns of the S&P 500 from 1926–2019. After the index has hit all-time highs, the subsequent one-, three-, and five-year returns are positive, on average. After the S&P 500 has fallen more than 10%, the subsequent one-, three-, and five-year returns are also positive, on average. Both data sets show returns that outperform those of one-month Treasury bills. Overall, the data do not support that recent market performance should influence the timing of investing in stocks.

EXHIBIT 1

Past performance is not a guarantee of future results.

Both theory and data suggest that lump-sum investing is the more efficient approach to building wealth over time. But dollar-cost averaging may be a reasonable strategy for investors who might otherwise decide to stay out of the market altogether due to fears of a large downturn after investing a lump sum.

The stock market has offered a high average return historically, and it can be an important ally in helping investors reach their goals. Getting capital into stocks, whether gradually or all at once, puts the holder in position to reap the potential benefits. A trusted financial advisor can help investors decide which approach—lump-sum investing or dollar-cost averaging—is better for them. What’s clear is that markets have rewarded investors over time. Whichever method one pursues, the goal is the same: developing a plan and sticking with it.

EXHIBIT 1: In US dollars. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market high observations. Declines are defined as months ending with the market below the previous market high by at least 10%. Annualized compound returns are computed for the relevant time periods after each decline observed and averaged across all declines for the cutoff. There were 1,127 observation months in the sample. January 1990–present: S&P 500 Total Returns Index. S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. January 1926–December 1989; S&P 500 Total Return Index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. For illustrative purposes only. Index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the management of an actual portfolio. “One-Month US Treasury Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Morningstar. There is always a risk that an investor may lose money.

—

Adapted from Dimensional’s Taking Stock of Lump-Sum Investing vs. Dollar-Cost Averaging.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

—

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Now that another tax season is in the rearview mirror, what lessons can you take from this year’s filing experience to strengthen your financial future?

Proper classification of meal expenses can help businesses maximize deductions while staying compliant with IRS regulations. Here’s what business owners need to know: 1. 50%…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.