Beaird Harris Named to Worth’s 2025 List of Top RIA Firms for Excellence in Wealth Management

Beaird Harris Recognized in Worth’s list of “Top RIA Firms” for 2025 Beaird Harris is proud to announce our inclusion in Worth’s prestigious list of…

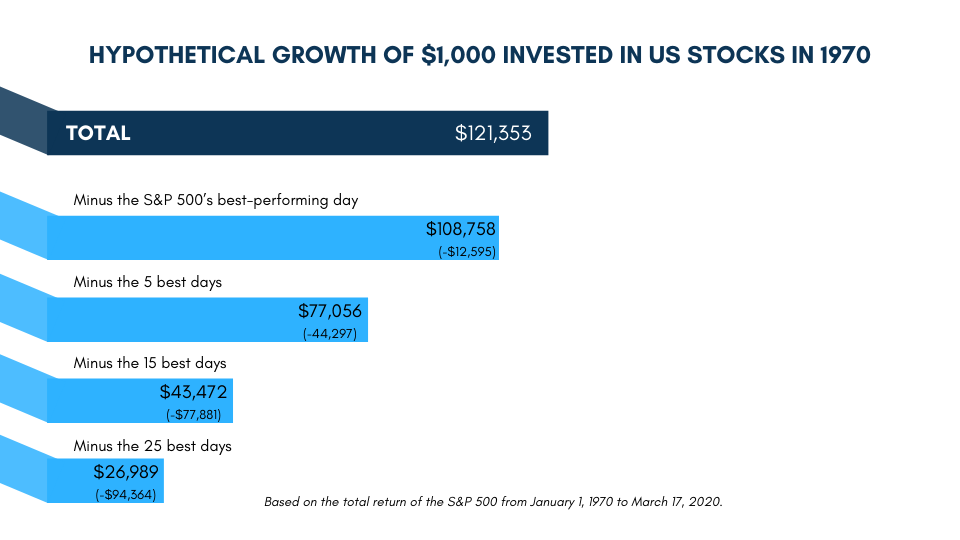

The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. Staying invested and focused on the long term helps to ensure that you’re in the position to capture what the market has to offer.

Missing only a few days of strong returns can drastically impact overall performance.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

—

Adapted from Dimensional’s The Cost of Trying to Time the Market. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars. For illustrative purposes. The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed best day(s), and reinvested the entire portfolio in the stocks in the S&P 500 at the end of the missed best day(s). Returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero. Performance data for January 1970–August 2008 provided by CRSP; performance data for September 2008–March 17, 2020 provided by Bloomberg. S&P data provided by Standard & Poor’s Index Services Group.

Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Beaird Harris Recognized in Worth’s list of “Top RIA Firms” for 2025 Beaird Harris is proud to announce our inclusion in Worth’s prestigious list of…

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Now that another tax season is in the rearview mirror, what lessons can you take from this year’s filing experience to strengthen your financial future?

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.