Beaird Harris Named to Worth’s 2025 List of Top RIA Firms for Excellence in Wealth Management

Beaird Harris Recognized in Worth’s list of “Top RIA Firms” for 2025 Beaird Harris is proud to announce our inclusion in Worth’s prestigious list of…

The collapse of First Republic Bank is a harsh reminder that any stock can go to zero, no matter how established a company is, or how loyal and wealthy its customers are. The failure of what many considered to be a rock-solid regional bank should serve as powerful evidence of the importance of diversification, what I consider to be one of the first principles of investing.

If your wealth is highly concentrated in any one individual stock, take this opportunity to learn an important lesson: While many people think they know more than other investors, none of us knows more than the market.

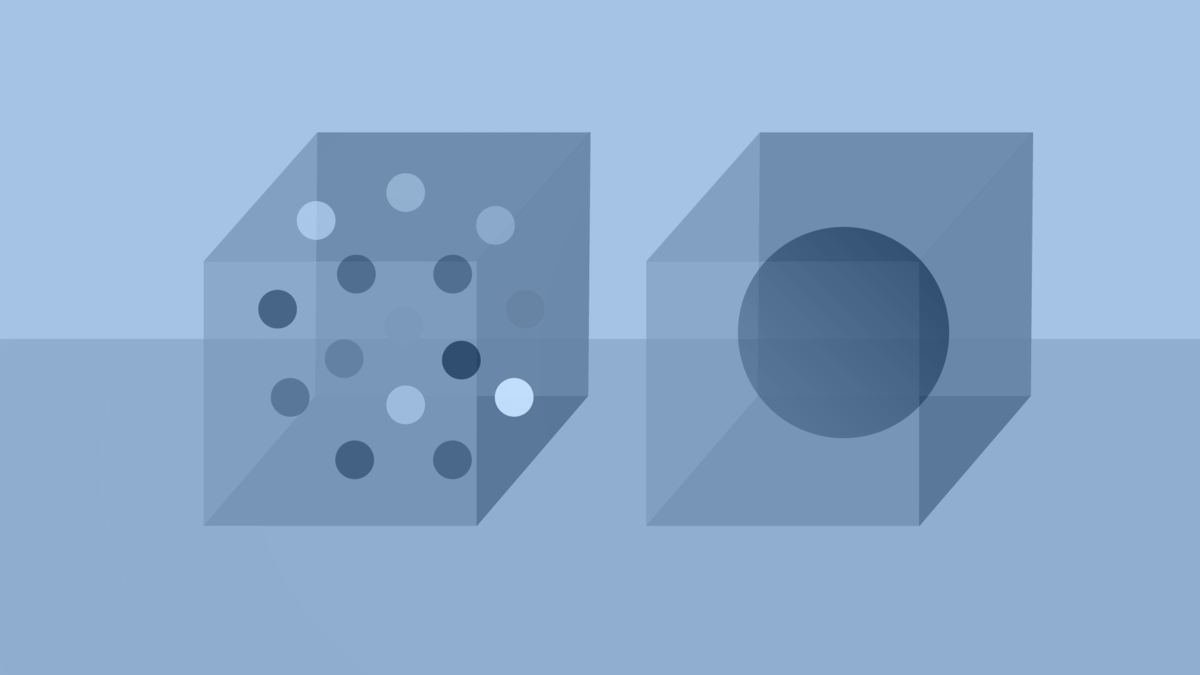

Many years before he became a Nobel laureate, Merton Miller used to say, “Diversification is your buddy.” Diversification is the practice of spreading investments across a variety of assets. It’s a time-tested strategy to mitigate risk. Children learn about it early in life with the phrase “Don’t put all your eggs in one basket,” but all too often, grown-up investors forget.

Anyone who lost their shirt when First Republic Bank stock lost its value had too much invested in it.

I think it’s safe to assume that the total value of the stock market will not go to zero. But the same cannot be said about any individual stock, no matter how promising the future of a company might seem. Why not? Because we cannot predict the future.

The current price of any stock reflects the value of all its future income streams, but it’s no guarantee. Some companies fail. Can anyone predict which ones? Fortunately, there’s no need to. You can have a positive investment experience without knowing what’s going to happen with any individual stock because of diversification. In investing, diversification is the closest thing any of us can have to a free lunch.

Nearly all investing horror stories start with a simple fact: Someone took too much risk. In the case of First Republic, management took too much risk. But investors don’t have to. Anyone who lost their shirt when FRB stock lost its value had too much invested in it. Everyone who invests in the stock market should prioritize diversification in their portfolio. And it’s never been easier to do so, because with mutual funds and ETFs—many of which allow you to invest in a broad range of stocks by buying just one security—you can achieve a high level of diversification with the same number of clicks as buying a single stock.

In my opinion, when you concentrate your wealth in single stocks, you’re gambling, not investing. And that’s fine, as long as you don’t mind losing what you bet. First Republic has been included as part of the S&P 500 index since 2018. On the day JP Morgan Chase announced that it was taking over the troubled bank, how did First Republic’s dissolution impact the S&P 500?1 When the market closed, the index was down 0.039%.2

Now do you see why diversification is your buddy?

FOOTNOTES

1 “First Republic Bank Is Seized, Sold to JPMorgan in Second-Largest U.S. Bank Failure,” Wall Street Journal, May 1, 2023.

2 S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Decrease of 0.039% was on May 1, 2023.

DISCLOSURES

Adapted from The Stock Market vs. Stocks in the Market by Dimensional Fund Advisors LP.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 Index. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, LLC To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Beaird Harris Recognized in Worth’s list of “Top RIA Firms” for 2025 Beaird Harris is proud to announce our inclusion in Worth’s prestigious list of…

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Now that another tax season is in the rearview mirror, what lessons can you take from this year’s filing experience to strengthen your financial future?

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.