Thinking About Selling Your Healthcare Practice? Read This First.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Whether you’ve been investing for decades or are just getting started, at some point you’ll likely ask yourself some fundamental questions. The 10 listed here highlight key principles, backed by data and common sense, that can help improve your odds of investment success.

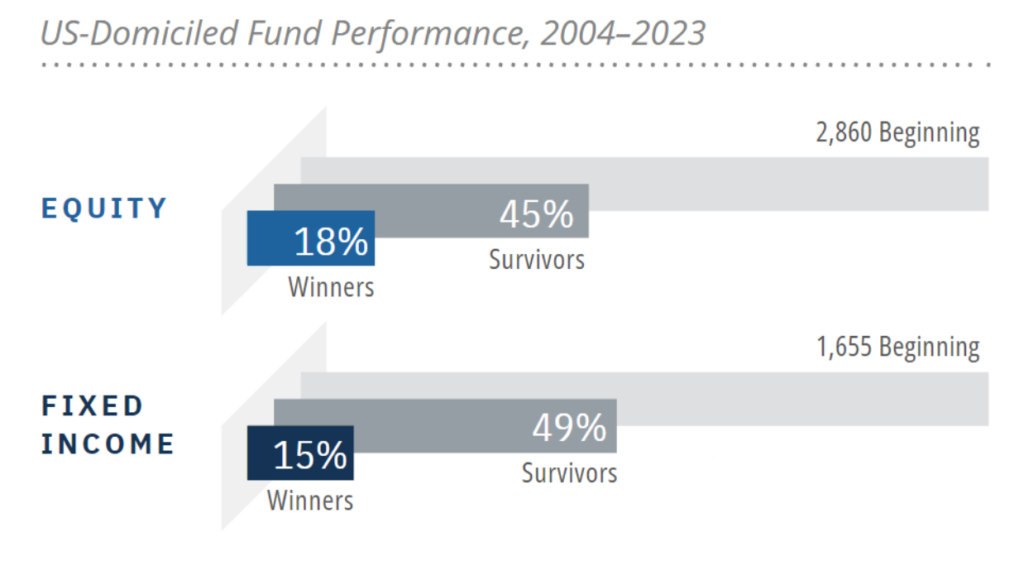

If mutual fund managers could consistently identify winning or losing assets, you would expect their returns to show it. But they don’t.

Historically, only about one in five funds survives and outperforms over 20 years. That’s based on research of 2,860 equity mutual funds that existed in 2004. Two decades later, more than half of these funds had folded, often due to poor performance. And only 18% of equity funds were able to survive and outperform their benchmarks over this period. Your chances are even worse for fixed income funds, where only 15% survived and outperformed. Are those odds you’d bet your savings on?

The market is an effective information-processing machine. Millions of people buy and sell stocks and bonds every day, and the real-time information they bring helps set prices. This means trying to outperform by finding securities that are priced too high or too low is difficult for anyone, even professional money managers.

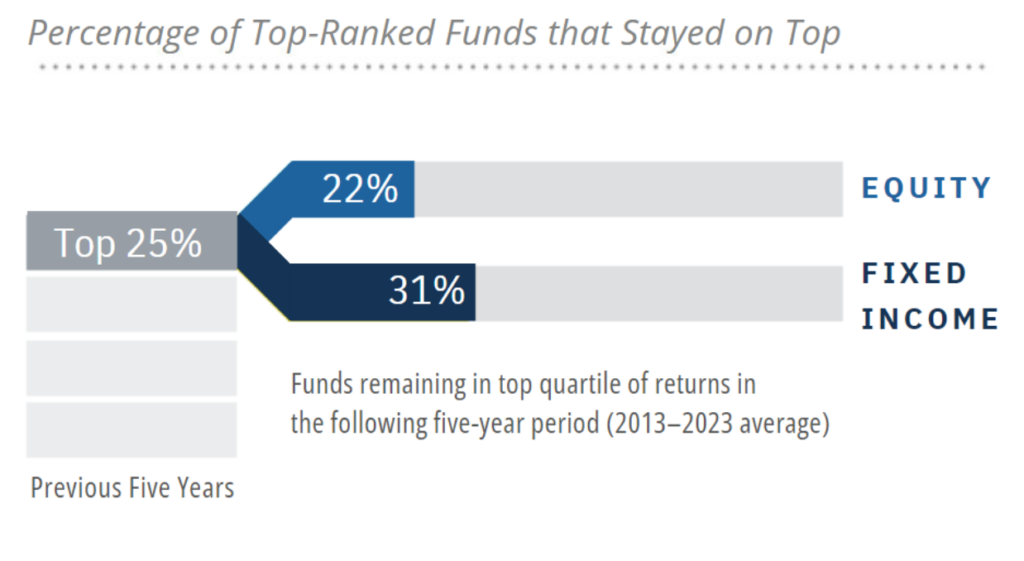

Some investors select funds based on past returns, but relatively few winners keep winning. Research shows that most mutual funds ranked in the top-performing 25% based on five-year returns did not remain in the top 25% in the next five years. Only around one in five of the top-performing equity funds stayed on top, and only about a third in fixed income did.

In other words, past performance offers little insight into a fund’s future returns.

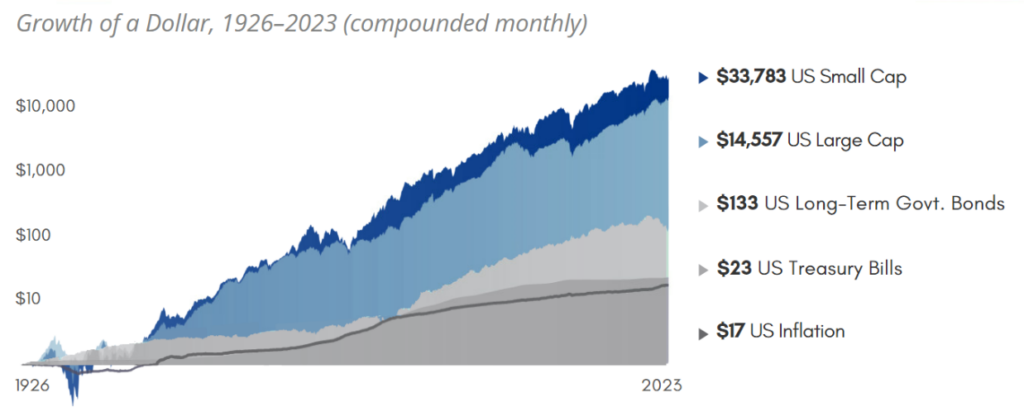

Rather than basing an investment strategy on trying to pick the winners and avoid the losers, one approach is to simply buy and hold a slice of a market index through an index fund, gaining ownership of many different stocks. Over the past century, that approach would have rewarded you with a return that far outpaced inflation—and it would have helped you avoid the stress of trying to predict the future.

But investing in index funds has its limitations, as an index fund is only trying to match the returns of an index, not beat them.

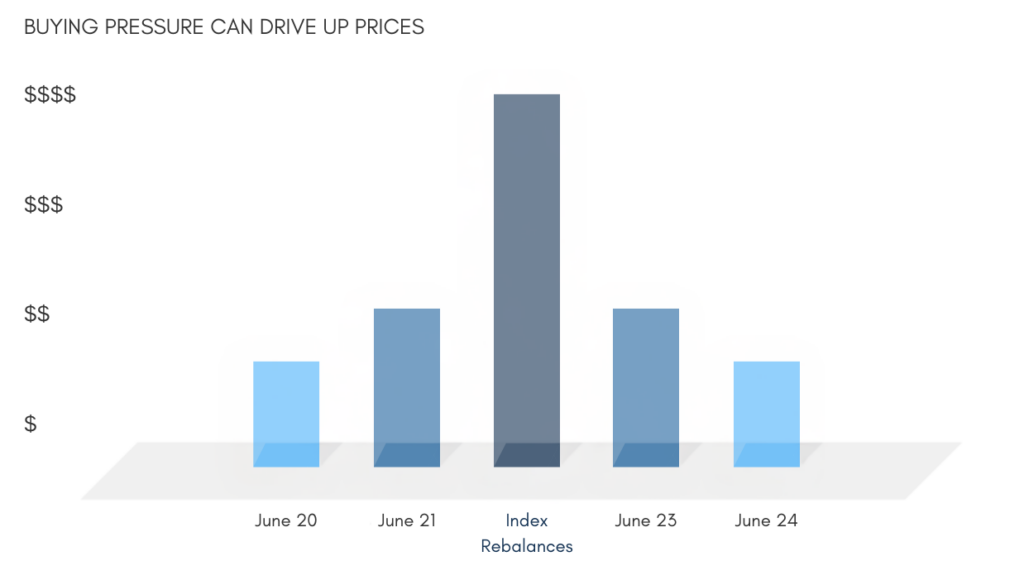

Yes, because index funds’ focus on matching—rather than beating—benchmarks can be unnecessarily rigid. For instance, index funds have to buy and sell stocks when the benchmark they track changes its holdings, which can happen as infrequently as once a year. Like shopping for roses on Valentine’s Day, that leads to a lot of people buying the same thing at the same time, which drives up prices. Constraints like this mean that when you invest in index funds, you may be leaving money on the table.

A more effective investment approach for fund managers is to be flexible, buying and selling stocks throughout the year based on information backed by financial science on what can improve expected returns.

Academic research into decades of stock returns has identified long-term drivers of outperformance. Smaller companies, those with lower prices, and those that are more profitable have had higher returns, on average. By investing systematically in the areas with higher expected returns, you can aim to beat the market.

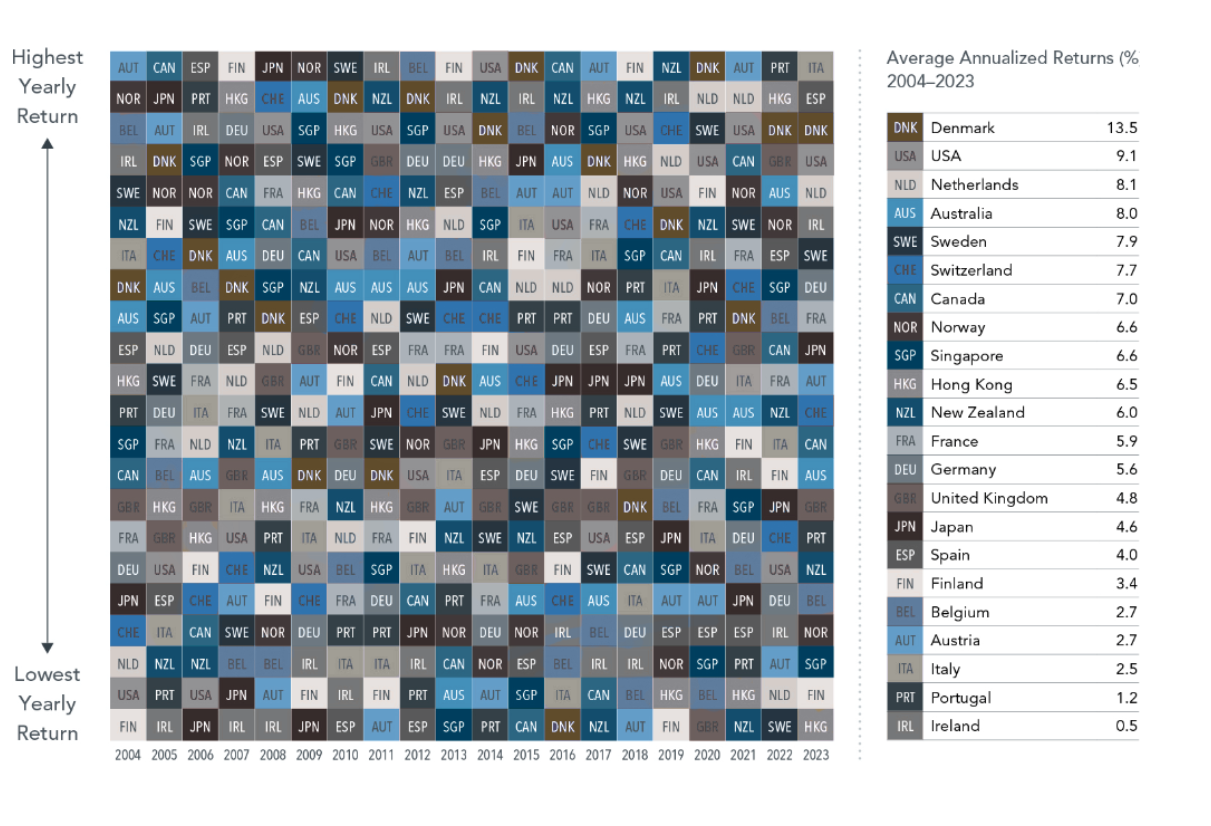

Investment opportunities exist all around the world, but the randomness of global stock returns makes it difficult to predict which markets will outperform from one year to the next. For example, Austria was the best-performing developed market in 2017 but the worst the next year (and, in 2021, the best again). Holding a globally diversified portfolio that targets higher expected returns better positions you to capture higher returns wherever they appear. And a strong year in one country can help offset a weaker one elsewhere.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification neither assures a profit nor guarantees against loss in a declining market.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification neither assures a profit nor guarantees against loss in a declining market.Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If you find the barrage of hot tips tempting or unsettling, consider the source and what is news vs. entertainment. Do yourself a favor: Tune out the noise.

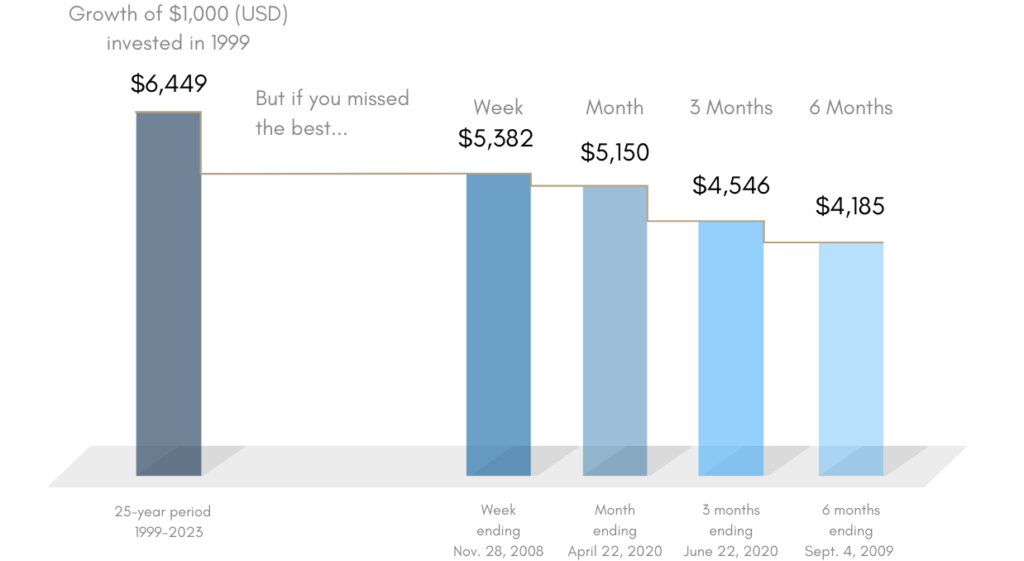

Markets go up and down each day. When they fall, it’s tempting to pull money out in the hopes of avoiding losses. You can put money back in when things turn around, right? Think again. Research has shown that there’s no reliable way to time the market. It has also shown that the impact of being out of the market can be profound, even for just a short time. Staying invested—focusing on the long term—helps to ensure you’re in position to capture gains when prices rise.

Russell 3000 Index total return, 1999–2023

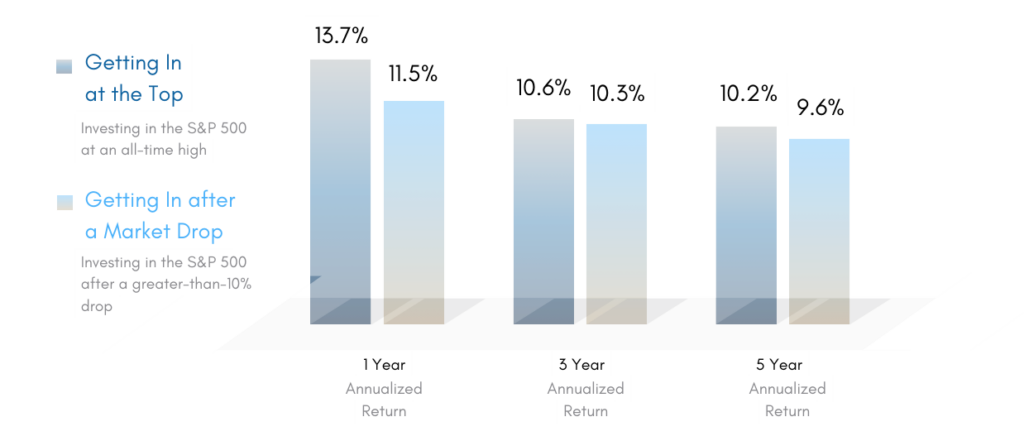

Every day, stocks are priced to deliver a positive expected return. That means now is always a good time to invest. This goes against the “buy low and sell high” mantra that leaves some people trying to find just the right moment to invest. Frequent reports of all-time market highs may keep you from buying, thinking surely what goes up must come down, so I better wait.

But research shows that buying shares at all-time records has, on average, produced similar returns to stocks bought following a sharp decline. That means trying to time when to get into and out of markets is unlikely to lead to better results.

S&P 500 ANNUAL RETURNS, 1926–2023

We rely on professionals in so many areas of our lives. When you get sick, you can scan the internet searching for a remedy—or you can go to a doctor who has years of training on the best, safest way to help. Trusting an expert with your financial health is no different.

A financial advisor can provide expertise and guidance. They can help you focus on taking constructive actions that add long-term value, not impulsive ones you may later regret. And they can help you build a portfolio based on financial science that is expected to outperform the market.

Consider whether you’d benefit from help with any of the below:

Looking for a fiduciary financial advisor to help you achieve your goals? Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.

No Professional Advice, Client Relationship, or Reliance on Information

Please note that any information or content on our Website, or any forms or tools on our Website which allow you to submit information or make calculations, and your use thereof, are not intended to provide any kind of professional advice, consultation or service, including but not limited to, legal, accounting, tax, or business advice. Nor does any such information, content, forms, or tools, or your use thereof or reliance thereon, create or constitute an attorney/client, accountant/client, or consultant/client relationship. You should therefore not use our Website or reliance on any information, content, forms, or tools on our Website as a substitute for any kind of professional advice. Rather, you should consult with a licensed professional, including one employed by our Company, for any accounting or tax questions you may have. You agree that we will not be liable to you or to any third party to the extent you treat or consider any information, content, forms, or tools on our Website as constituting any kind of professional advice. The information and content, including but not limited to forms and tools, presented on or made available through our Website are made available solely for general information purposes. We, therefore, do not warrant the accuracy, completeness or usefulness of any such information, content, forms, or tools, and any reliance you place on the same is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to our Website, or by anyone who may be informed of any of its content.

Our Website provides illustrative lists of services that we provide. Nothing contained on our Website shall be construed as an offer or guarantee to provide any particular services to you, nor shall anything on our Website be construed as a direct solicitation for employment by any persons, companies, or organizations. Prior results we have obtained for others do not guarantee a similar outcome.

INDEX DESCRIPTIONS:

CSRP 6–10 Index—The universe includes all common stocks listed on the NYSE, NYSE MKT, and Nasdaq National Market excluding unit investment trusts, closed-end funds, REITs, Americus Trusts, foreign stocks, and American depositary receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles by market capitalization, the largest being in decile 1. The largest capitalizations in each decile serve as the break points that are applied to various exchange groupings of the universe. CRSP 6–10 measures the performance of the bottom five deciles. CRSP data is provided by the Center for Research in Security Prices, University of Chicago.

S&P 500 Index—The index measures the performance of the large cap segment of the market. Considered to be a proxy of the US equity market, the index is composed of 500 constituent companies. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

IA SBBI US LT Govt TR USD—The index measures the performance of a single issue of an outstanding US Treasury bond with a maturity term of around 21.5 years. It is calculated by Morningstar and the raw data is from Wall Street Journal (WSJ).

IA SBBI US 30 Day TBill TR USD—The index measures the performance of a single issue of an outstanding Treasury bill that matures closest to, but not beyond, one month from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month, that issue is sold and rolled into a newly selected issue. The index is calculated by Morningstar and the raw data is from WSJ. US long-term government bonds and Treasury bills data is provided by Ibbotson Associates via Morningstar Direct.

US Inflation—Represented by the Consumer Price Index for All Urban Consumers (CPI–U), not seasonally adjusted. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Now that another tax season is in the rearview mirror, what lessons can you take from this year’s filing experience to strengthen your financial future?

Proper classification of meal expenses can help businesses maximize deductions while staying compliant with IRS regulations. Here’s what business owners need to know: 1. 50%…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.