Understanding the Deductibility of Meals for 2024 Tax Returns

Proper classification of meal expenses can help businesses maximize deductions while staying compliant with IRS regulations. Here’s what business owners need to know: 1. 50%…

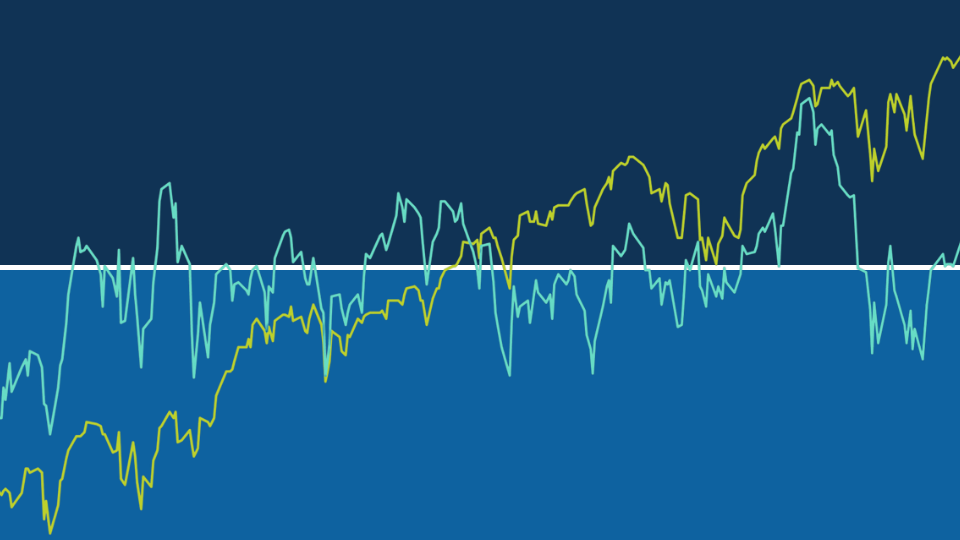

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. However, they may be surprised to find that the average returns one, three, and five years after a new month-end market high are similar to the average returns over any one-, three-, or five-year period.

Reaching a new high doesn’t mean the market will retreat. Stocks are priced to deliver a positive expected return for investors, so reaching record highs regularly is the outcome one would expect.

Disclosures

Adapted from Why a Stock Peak Isn’t a Cliff by Dimensional Fund Advisors. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. For illustrative purposes only. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market highs observations. There were 1,151 observation months in the sample. January 1926–December 1989: S&P 500 Index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. January 1990–Present: S&P 500 Index (Total Return), S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Proper classification of meal expenses can help businesses maximize deductions while staying compliant with IRS regulations. Here’s what business owners need to know: 1. 50%…

President Trump signed legislation repealing IRS reporting rules for decentralized finance (DeFi) platforms, easing compliance burdens but leaving individual taxpayers responsible for accurate crypto reporting.

Certain non-traditional investments held in an IRA — like active business interests or leveraged real estate — can trigger Unrelated Business Income Tax (UBIT), potentially…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.