Market Update – Coronavirus

At the time of this writing, the Centers for Disease Control (CDC) warned that Coronavirus (COVID-19) is likely to spread in the U.S. Right now,…

At the time of this writing, the Centers for Disease Control (CDC) warned that Coronavirus (COVID-19) is likely to spread in the U.S. Right now,…

Taxpayers With Undisclosed Foreign Accounts and Activities Beware: The IRS and Other Taxing Authorities Are Coordinating Efforts to Tackle International Tax Evasion U.S. citizens, resident…

The IRS recently issued new cryptocurrency guidance and is intensifying its efforts to identify taxpayers who bought or sold cryptocurrency and didn’t report it on…

The SECURE Act is the largest change to corporate retirement plan laws since the Pension Protection act of 2006, so if you are a business…

Non-Spouse Beneficiaries The Act does away with the ability to “stretch” required minimum distributions (“RMDs”) over their lifetime. This is not retroactive, so it will…

Over the course of the holidays, it’s not unusual for the stock market to be a topic of conversation at a dinner party or other…

Over the course of the holidays, it’s not unusual for the stock market to be a topic of conversation at a dinner party or other…

Is the market getting by with a little help from the FAANGs? And does their performance stand out historically? Investors may be surprised that it’s…

2019 has flown by and we are quickly approaching the holiday season. It is also year-end tax planning season and we are here to help!…

On June 21, 2018, the Supreme Court of the United States handed down a historic decision in the sales and use tax nexus case South…

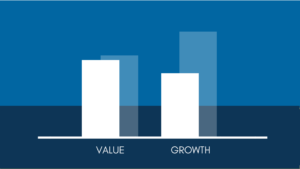

Has value really lost its vigor? While growth stocks have outperformed in the past decade, value returns have largely tracked their long-term historical average. There’s…

IRS2Go is the Official Mobile App of the IRS Check your refund status, make a payment, sign up for helpful tax tips, and more! IRS2Go…

We’ll help you get started and learn more about Beaird Harris.