Thinking About Selling Your Healthcare Practice? Read This First.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

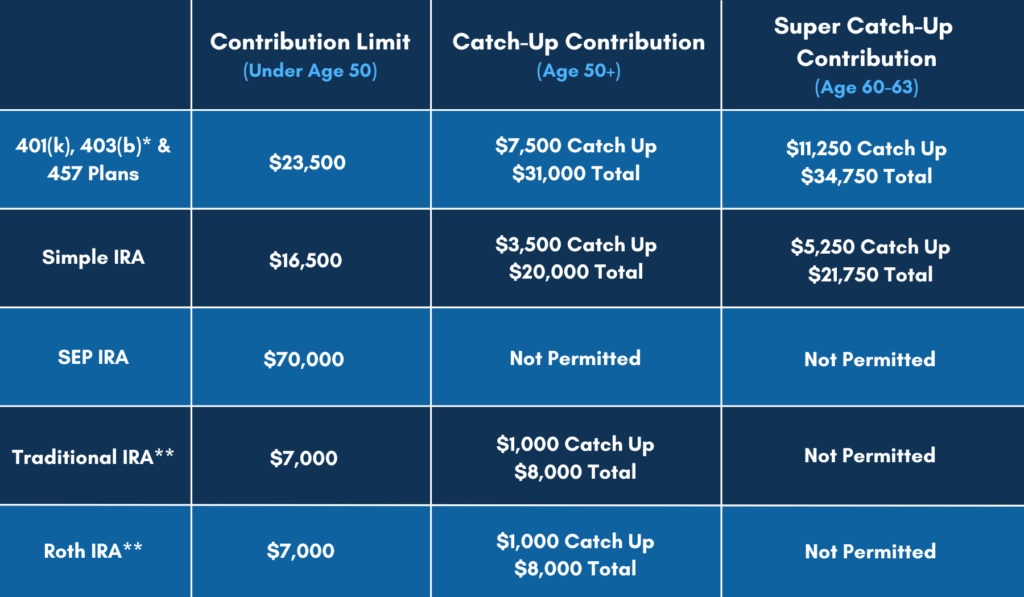

In 2025, most employees can put up to $23,500 into their 401k and similar retirement plans. People 50 years or older (as of December 31st, 2025) can add an extra $7,500 to help grow their savings as they get closer to retirement age. This is called a catch-up contribution, which increases their total possible contribution to $31,000.

In 2025, people 60-63 years old (as of December 31, 2025) will get a special savings opportunity called a “super” catch-up contribution, where employees can add an extra $11,250 to their usual maximum 401k contributions, increasing their total possible contribution to $34,750. However, once you turn 64, your contribution limit will revert back to the 50+ catch-up limit of $7,500.

*Employees with at least 15 years of service may be eligible to make additional contributions to a 403(b) plan in addition to the regular catch-up for participants who are age 50 or over. **Subject to income limitations.

*Employees with at least 15 years of service may be eligible to make additional contributions to a 403(b) plan in addition to the regular catch-up for participants who are age 50 or over. **Subject to income limitations.The good news? You don’t have to wait for your actual birthday to get started. You’re eligible to start contributing extra the year you hit 50 for catch-up contributions or 60-63 for super catch-up contributions!

How to Get Started

To begin making these additional contributions, you will need to:

Important Deadlines to Remember:

Why This Matters

The ability to increase your retirement contributions during the final stretch of your career can make a significant difference in your financial security. These changes offer a valuable opportunity to accelerate savings and ensure you’re on track to meet your retirement goals.

If you have questions about how these changes fit into your retirement strategy or need assistance adjusting your contributions, feel free to reach out. We’re here to help you take full advantage of these new provisions and keep your retirement planning on track.

DISCLOSURE: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC -“Beaird Harris”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris. Please remember that if you are a Beaird Harris client, it remains your responsibility to advise Beaird Harris, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Beaird Harris’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: Beaird Harris does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Beaird Harris web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

At Beaird Harris, we understand that selling a medical or dental practice isn’t just a financial decision—it’s a deeply personal one. After years of serving…

Now that another tax season is in the rearview mirror, what lessons can you take from this year’s filing experience to strengthen your financial future?

Proper classification of meal expenses can help businesses maximize deductions while staying compliant with IRS regulations. Here’s what business owners need to know: 1. 50%…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.