2024-25 Annual Tax Planning Guide For Individuals And Families

A tax planning guide for individual income tax planning and family tax planning strategies at 2024 year-end moving into 2025.

This tax planning guide reflects the tax considerations and developments that we believe may create risk or opportunity for businesses in 2024 and beyond. It is not an exhaustive list of all tax issues that may affect your business, but it is designed to help you make informed planning decisions.

Businesses in 2024 continue to contend with unfavorable tax law changes and reconfigured deductions from the last few years. Meanwhile, the IRS has strengthened its enforcement capabilities by upgrading its technologies and building its workforce, underscoring the importance of compliance and accurate reporting.

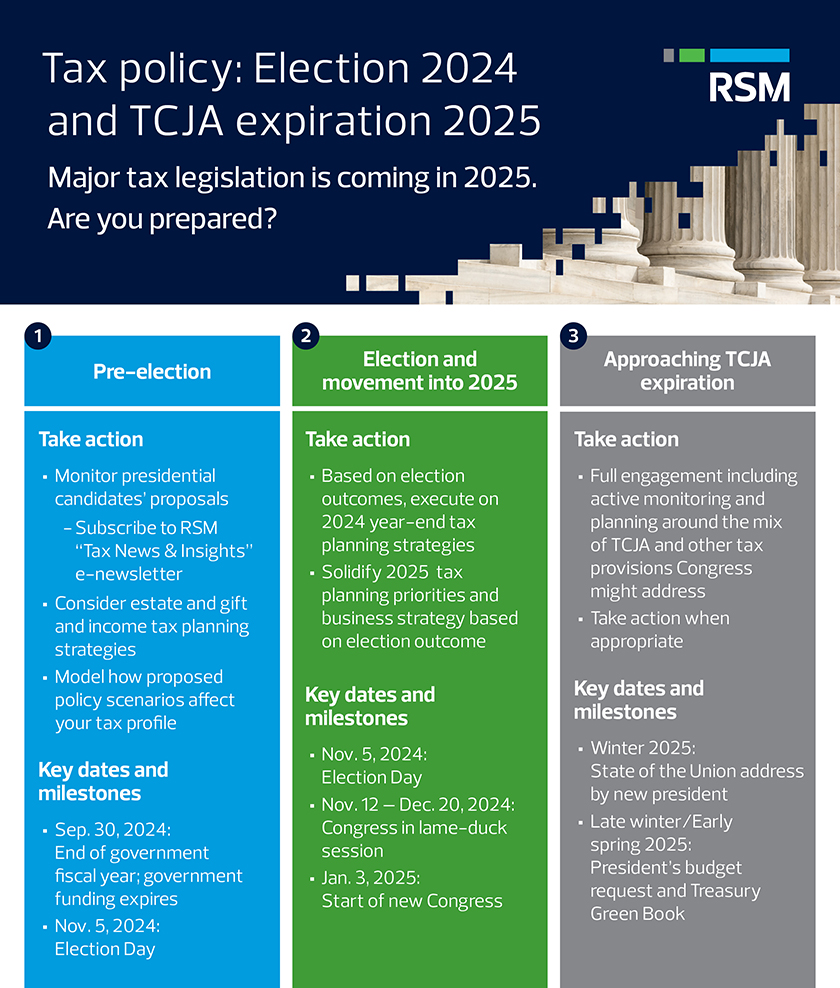

Against that backdrop, the transition into 2025 is shadowed by uncertainty about potentially transformative tax legislation under a new administration and new Congress. But there is risk to sitting idle, and, indeed, taxpayers need not be paralyzed by the uncertainty.

Key decisions—including those related to business models, choice of entity, workforce and compensation, tax accounting methods and general tax planning—should be top of mind for businesses as they work with their tax advisor to monitor political dynamics, legislative proposals and economic conditions. Prepare now to make informed, timely decisions once the path forward comes into focus.

RSM presents this guide to assist you in that preparation by summarizing tax developments and concepts that have commanded taxpayers’ attention in 2024.

The road to significant tax law changes in 2024 was blocked by more than the partisan divisions that have come to characterize legislative dynamics in general. The prospect of changes stemming from 2024 general election outcomes amounted to a stop sign at a crossroads entering 2025.

Specifically, the Tax Relief for American Families and Workers Act of 2024 proposed expanding the child tax credit and temporarily reinstating certain business tax benefits that were part of the Tax Cuts and Jobs Act of 2017 (TCJA), including:

Bipartisan support for the business tax provisions, at least, was evident as the House of Representatives passed the bill by a vote of 357-70 on Jan. 31. Subsequently, however, the notion of a new president and reconfigured congressional majorities in 2025 helped stymie the legislation. The bill stalled in the Senate and on Aug. 1 was voted down, 48-44, mostly along party lines. Senate Republicans commonly cited displeasure with the expanded child tax credit provision.

With that stalemate in place, at least temporarily, lawmakers and taxpayers turned toward the 2024 election and the likelihood of significant tax law changes in 2025. With a new president and Congress set to take office in January, conditions are ripe for legislative action that could remake the U.S. tax landscape. More than 30 provisions in the TJCA are scheduled to expire at the end of 2025, and a host of other tax provisions are potentially in play.

Most businesses, including those in the middle market, are organized as pass-through entities, a structure that offers challenges as well as benefits. Laws that govern such entities—and apply to the individuals that own them—are complex and continuously changing. As such, it is crucial for business owners to work with their tax advisor to identify and address areas of potential impact on their business.

Appropriate planning can help minimize negative tax implications and maximize tax benefits for owners and their businesses, facilitating compliance with applicable laws and preventing unnecessary and unforeseen surprises.

Topics frequently relevant to pass-through businesses and their owners include but are not limited to:

Section 199A of the Internal Revenue Code (IRC) allows taxpayers to deduct up to 20% of their qualified business income (QBI), which generally includes most types of trade or business income reported on an individual’s tax return—often income attributable to an owner’s share of pass-through income. Notably, foreign source, investment, and specified service trade or business income does not qualify for the deduction. Income classified as QBI effectively reduces the top tax rate from 37% to 29.6%.

Taxpayers either availing themselves of the QBI deductions or contemplating doing so should consider the following:

The TCJA limited the individual taxpayer deduction for state and local tax (SALT) payments to $10,000 a year ($5,000 for a married person filing a separate return). Consequently, the owners of pass-through entities subject to state taxes are now responsible for these expenses, which from a practical standpoint have become nondeductible.

In response to the issue, a growing number of states have adopted workarounds intended to enable the entity (and its owners) to generate a deduction for these state tax obligations.

Taxpayers subject to the SALT deduction limitations should analyze the following:

Historically, purchasers of partnership interests were able to generate additional depreciation deductions through step-up elections; however, these step-ups were not eligible for bonus depreciation, as they generally represented the indirect purchase of a used asset. The TCJA, however, changed this rule to allow bonus depreciation for purchases of used assets. Final rules issued by the IRS clarify how the changes affect step-up depreciation generated by the acquisition of an interest in an existing partnership and similar transactions.

Taxpayers considering transactions that may generate a step-up should analyze potential bonus depreciation benefits by:

Individuals, closely held C corporations and personal service corporations are generally restricted in their ability to deduct losses from passive activities. Passive losses include losses from rental activities and other business activities in which the taxpayer is not actively involved.

However, taxpayers who can demonstrate the necessary level of participation may be able to generate a current deduction for these losses and realize significant income tax savings. (See discussion below regarding excess business losses for an additional loss limitation.)

Taxpayers with passive losses should analyze the following:

The excess business loss (EBL) limitation provides an additional hurdle for taxpayers seeking to deduct losses from their business activities. Originally enacted as part of the TCJA, the provision was subsequently extended by both the CARES Act and the Inflation Reduction Act of 2022 to tax years beginning before Jan. 1, 2029. The provision limits noncorporate taxpayers to a $305,000 ($610,000 for married couples) aggregate loss from their business activities for tax year 2024 (indexed for inflation).

Taxpayers potentially facing additional hurdles due to the EBL limitation should consider the following:

Most businesses consider their entity structure only once—at the time of formation. However, passage of the TCJA, along with the potential for further changes, has led many C corporations, partnerships, limited liability companies (LLCs) and S corporations to reconsider their choice of entity.

Taxpayers should consider the following important questions in their ongoing assessment of choice of entity:

The Treasury Inspector General for Tax Administration (TIGTA) released a report in August 2021 assessing IRS efforts to identify underreporting of compensation paid to S corporation shareholders—specifically, the risk of S corporations disguising shareholder compensation as distributions. The report sought to determine whether IRS policies, procedures and practices ensure that compensation is considered during the IRS examination process.

The report determined that the IRS was not identifying the issue as frequently as it should. The report also made several recommendations to surface the issue more often during the audit process. In its response, the IRS rejected most of TIGTA’s recommendations, but the collective focus on this issue is clear.

Taxpayers classified as S corporations should consider:

Several U.S. Tax Court decisions, in conjunction with other forms of guidance—including long-standing and controversial proposed regulations—have created an unclear picture as to the treatment of members of LLCs and limited liability partnerships (LLPs) under the self-employment tax rules.

The IRS has taken aggressive positions in this area. Recent decisions indicate that in certain cases LLCs may want to consider modifying their governance rules to substantiate the fact that certain portions of income are exclusively a return of capital (and not compensation for personal services), or consider adopting a limited partnership structure. However, several cases are pending before the courts in 2024 in which the IRS appears to be challenging even limited partnership structures.

The recent decision in Soroban Capital Partners LP et al. v. Commissioner has injected further uncertainty into the application of self-employment tax to limited partners in a state law limited partnership.

Consider the following:

The TCJA added a new provision affecting the treatment of carried interest, defined generally as partnership interest received in exchange for services in certain specified businesses in the investment and real estate industries. This provision has the practical impact of converting long-term capital gain income into short-term capital gain income in certain circumstances.

Taxpayers with carried interest should consider the following:

Over the last few years, the IRS has subjected partners and S corporation shareholders to expanded reporting requirements. Notably, S corporation shareholders have, for a number of years, been required to include a basis schedule with their tax return when receiving a distribution, selling stock, recognizing a loss or receiving a loan payment.

The IRS standardized this disclosure in early 2022 with the issuance of Form 7203. Accordingly, for 2021 tax returns and later, shareholders are now required to include Form 7203 with their return filings when the shareholder receives a distribution, sells stock, recognizes a loss or receives a loan payment.

Meanwhile, partnerships are required to report the beginning and ending tax basis capital for each partner. In 2019, this partnership reporting was required only if either amount was negative; beginning in 2020, this rule applies to all partners and partnerships.

Taxpayers who are shareholders in S corporations or partners in a partnership should be aware of the following reporting requirements:

Partnership planning must consider the possible effects of a transaction or tax position on different partners, both current and future. Issues that may seem straightforward may be surprisingly complex when partner-level effects are considered.

A host of corporate and transaction-related tax issues stem from the high interest rate environment and overall economic climate, as well as from tax code changes and updated guidance. These tax issues affect many companies’ cash flows, tax obligations and tax attributes. By embracing the planning considerations discussed below, companies can optimize the tax outcomes of various transactions and minimize costly surprises.

A business environment of higher interest rates on debt has created cash flow issues for many companies, forcing them to restructure or refinance existing debt obligations.

Prior to restructuring debt, it is critical that businesses evaluate their options and the corresponding debt restructuring tax implications. With effective analysis and planning, companies can maximize available tax benefits, such as net operating losses (NOLs), and mitigate tax costs associated with issues such as cancellation of debt income (CODI). Businesses facing economic hardship should proactively maximize company value through proper planning.

Additionally, companies that have refinanced debt should evaluate whether any previously unamortized debt issuance costs are eligible for accelerated tax deduction during the current year. Companies should also assess whether certain fees paid to lenders as part of a refinancing or issuance of new debt constitute an original issue discount (OID), which is amortized over the debt’s life and may be subject to the business interest deduction limitation under Internal Revenue Code (IRC) section 163(j).

Due to the current environment, taxpayers should consider disposing of struggling subsidiaries. Consolidated taxpayers with an insolvent subsidiary should also evaluate whether they may claim a deduction for worthless stock. Claiming the deduction may require liquidating the insolvent subsidiary, converting it into a limited liability company or disposing of it.

Consider the following questions:

Learn more:

The 1% excise tax on certain stock repurchases

As part of the Inflation Reduction Act, Congress imposed a new 1% tax on certain corporations that repurchase (buy back) their stock from their shareholders at a value exceeding $1 million per year. The corporations subject to this tax are domestic corporations traded on an established securities market and certain foreign corporations. The tax applies to buybacks occurring after Dec. 31, 2022.

In June 2024, the IRS and Treasury Department issued regulations interpreting the stock buyback tax. The regulations clarify the filing requirements for this tax, as well as its application and calculation.

The corporate alternative minimum tax

Congress also imposed a corporate alternative minimum tax (CAMT) of 15% on the “adjusted financial statement income” of certain large corporations that meet a $1 billion average annual adjusted financial statement income test ($100 million in the case of certain U.S. corporations that are members of a foreign-parented multinational group—provided the multinational group also meets the $1 billion threshold). Related entities may be required to aggregate their income to determine whether they are subject to the CAMT. The CAMT is effective for taxable years beginning after Dec. 31, 2022.

Consider the following questions:

If you answered yes to all of the above, the stock buyback tax may apply to you.

Learn more:

The Tax Cuts and Jobs Act of 2017 amended IRC section 174 for tax years beginning after Dec. 31, 2021. Under the new rule, specified research and experimental expenditures (section 174 costs) are no longer deductible but are chargeable to a capital account and amortized over a five-year period (15-year period for foreign research expenditures).

Taxpayers generally cannot write off unamortized section 174 costs merely because the project or activity is disposed of or abandoned. If disposing of the entirety of their business in a mergers and acquisitions (M&A) transaction, however, some taxpayers have taken the position that they can write off such costs.

The IRS issued interim guidance in this area in September 2023 but has not yet issued regulations. Because this IRS guidance is limited and leaves questions unanswered, we recommend taxpayers assess the treatment of section 174 costs in the context of an M&A transaction on a case-by-case basis.

Consider the following question:

Corporations should carefully monitor changes in stock holdings that occur during the year to identify whether the corporation may have undergone a section 382 ownership change. If so, the company may make a closing-of-the-books election, which may result in significant tax benefits.

If it files a closing-of-the-books election with its timely filed tax return, the corporation closes its books on the date of change for section 382 purposes, thereby specifically measuring income and deductions pre- and post-change. Without the election, under the default rule, the corporation applies daily proration of the entire year’s items of income and deductions.

In situations where section 382 would limit the ability to offset income post-transaction, section 481 enables some taxpayers to accelerate income into the year of certain M&A transactions and possibly into the prior year. Under IRS procedural rules, for certain accounting method changes a taxpayer must file the method change request prior to the end of the tax year in order to obtain this treatment.

In September 2019, the IRS and the Treasury Department proposed new regulations under section 382 that limit the use of certain tax attributes, including NOLs, following a corporation’s ownership change.

One major departure from the current rules is the proposed removal of one of two safe harbors for calculating the recognition of built-in gain—the IRC section 338 approach, which is generally more favorable for companies with built-in gain. If these proposed regulations are finalized in their current form—a somewhat unlikely development—many companies (especially life sciences and technology companies, which often derive most of their value from self-created intangibles) would be negatively affected.

Whether the proposed regulations will be finalized in their current form is uncertain. Nonetheless, companies contemplating an upcoming ownership change (e.g., through a stock offering) might consider accelerating the ownership change to take advantage of the section 338 approach.

Consider the following questions:

During year-end planning, it may be important for a corporation to project the remaining current-year earnings to determine whether any distributions made during the year would be treated as derived from its earnings and profits, and thus be taxable as dividends or subject to withholding tax. These projections can also aid companies planning to distribute cash (or other property) to shareholders in deciding in which tax year to make the distribution.

A corporation that takes organizational actions affecting its shareholders’ stock basis generally must file IRS Form 8937 within the earlier of 45 days or Jan. 15 of the following year.

Organizational actions include distributions that are fully or partially nontaxable (which reduce basis), stock splits, some stock dividends and some reorganizations. S corporations may report the required information on Schedule K-1, and a corporation may meet the filing requirements through a posting on its website. Corporations should analyze their transactions to ensure they meet the filing requirements in a timely manner.

Consider the following questions:

A business that entered into a transaction with negative tax consequences can sometimes rescind the transaction and unwind those consequences. The IRS has sanctioned rescission in some cases (Rev. Rul. 80-58), but rescission is difficult to accomplish and often requires a valid business purpose. Because a rescission must occur within the same tax year as the transaction, the topic of rescission warrants consideration as part of year-end planning.

Consider the following question:

With effective tax planning for buy-side and sell-side mergers and acquisition transactions, restructurings and reorganizations, we can help you protect and maximize the value of your transactions.

Accounting Standards Codification 740 has become increasingly complex in recent years due to additional complexity in tax laws, the frequency at which tax laws change, increased scrutiny of financial reporting and additional financial reporting requirements. Companies that implement the following ideas will be better positioned to tackle future challenges related to accounting for income taxes.

The Financial Accounting Standards Board released Accounting Standards Update (ASU) 2023-09 in December 2023. The ASU requires additional income tax disclosures around effective tax rates and cash income taxes paid. ASU 2023-09 is effective for public business entities for annual periods beginning after Dec. 15, 2024 (generally, calendar year 2025), and effective for all other business entities one year later. The ASU requires adoption of this guidance on a prospective basis, though retrospective application is permitted.

As the first anniversary of its release approaches, companies should:

Given the requirements of ASU 2023-09 and increasing demands on companies’ tax departments, companies should consider implementing software and other process improvements as part of their year-end planning.

An effectively implemented provision software solution can reduce the time spent on provision preparation, enhance calculation accuracy, and provide a powerful engine for modeling the tax effects of changes in tax law or changes within the company.

In assessing the benefits of a software solution, companies should:

RSM offers corporations a technology-enabled, customized approach to meeting tax accounting and compliance needs.

Timing items with no lifetime taxable income impact might not always get full attention from tax professionals or executives. However, aligning accounting methods with cash flow goals and long-term tax plans is a smart strategy for 2024 and into 2025 due to ongoing changes in legislation and business conditions.

The companies we talk to are looking to mitigate the negative impact of higher interest rates and changes to business deductions such as research costs, business interest expense and tax depreciation. With planned shifts in the tax landscape at the end of 2025, regardless of 2024 election outcomes, longer-term planning becomes essential.

Bonus depreciation is presently 60% for property placed in service during calendar year 2024, and phases down to 40% for property placed in service during 2025. Bonus depreciation is scheduled to be fully phased out for property placed in service after 2026. Those timelines are extended for one year for certain property with a long production period.

Taxpayers should plan for and model the impact of decreasing bonus depreciation in future years. Taxpayers with significant capital expenditures should consider solutions to accelerate the placed-in-service date of qualifying property (to benefit from a higher bonus percentage) as well as other ways to mitigate the impact of reduced depreciation deductions.

Consider the following solutions to mitigate the negative impact of the bonus depreciation phasedown:

Inventory management and supply chain optimization have become focus areas in the manufacturing and consumer products industries. Inventory planning around year-end may allow a company to increase deductions or reduce taxes payable in the current year.

Prior to year-end, companies should identify:

Potential subnormal goods

Determine whether any finished goods on hand are unsalable at normal prices or unusable in the normal way because of damage, imperfections, shop wear, changes of style, or odd or broken lots. There may be an opportunity to write down those goods to a bona fide selling price, less the direct cost of disposition.

Obsolete goods

Review inventory before year-end and determine how to establish the value of any obsolete goods for federal income tax purposes. This may involve the physical scrapping of goods or valuing them as subnormal, as described above.

Working capital and debt allocable to the cost of carrying inventory

Companies with significant debt and a business interest expense limitation may be able to take advantage of long-standing tax provisions that allow amounts incurred to carry property to be capitalized as inventory costs. Doing so may help mitigate some of the business interest expense limitation.

With many tax provisions in the Tax Cuts and Jobs Act of 2017 scheduled to phase out over the next few years, taxpayers should continue to model the impact of sunsetting provisions.

Accounting method planning continues to be key for:

In certain cases, a taxpayer may be able to take (or delay) an action in order to achieve a result in line with their present accounting method. For example, a cash method taxpayer who defers payment of an expense to defer the associated deduction can continue using the cash method. In other cases, the taxpayer may have to change an accounting method in order to achieve the desired result.

All accounting method changes require the taxpayer to request consent from the IRS prior to implementing the change. Many accounting method changes qualify for “automatic” consent that is deemed granted as soon as the taxpayer files the appropriate form requesting the change; however, certain changes require “nonautomatic” consent. Nonautomatic accounting method changes require the taxpayer to request consent prior to year-end.

Taxpayers should consider the following items that require action before year-end:

Factual changes that may not require an accounting method change

Common nonautomatic accounting method changes

Learn more:

RSM can help determine how your company can take advantage of more favorable allowable accounting methods and elections including Form 3115.

Because the cost of your workforce includes the tax impacts of compensation and benefits, proper tax planning is crucial to maximizing the return on investment in your workforce.

While compensation is a strategic investment in the sustainable profitability of your organization, a great compensation strategy does more than just pay higher salaries than your competitors. It also drives lower labor costs per unit and higher profits because it incentivizes employees to be more productive, improving the bottom line.

To that end, the workforce’s top concerns and values are shifting amid an inflationary environment in which wages haven’t necessarily kept pace with the increased cost of living and economic conditions feel less certain.

Expiring provisions in the Tax Cuts and Jobs Act of 2017 (TCJA) will have some implications for compensatory payments. Assuming tax rates will go up, it may be beneficial to accelerate compensation income for the individual, although that benefit has to be weighed against the reduced deduction for the employer.

There are also new rules regarding employer deductions for expenses associated with eating facilities and with certain meals, and expanding the group of covered employees for whom public employers can claim limited compensation deductions. Though these rules are not effective until 2026 and 2027, respectively, advance planning may be necessary to properly implement them.

The TCJA added a new subsection (o) to Internal Revenue Code section 274. Effective for amounts paid or incurred after Dec. 31, 2025, section 274(o) will disallow deductions for certain meals and for the operational expenses of certain eating facilities.

Specifically, as of Jan. 1, 2026, the following expenses will be nondeductible:

IRC section 162(m) imposes a $1 million deduction limitation for compensation paid to covered employees of public filers. For tax years beginning after 2026, the section adds five more of the highest-compensated employees to the definition of covered employees, regardless of whether they are officers.

Evaluate the following:

Most organizations have key employees who are vital to steering the company’s vision, strategy, and culture and executing the core business. Given the amount of change in the world in the past few years, your organization’s vision and strategy may have changed, or the priorities and desires of those key employees may have evolved—or both.

Often, these key organizational decision makers and tone setters need to be compensated in additional ways compared to lower-level employees. This is the case for several reasons:

Consider these questions:

Understand how companies benefit from compensation and benefits planning:

The range of compensation and benefits programs to attract and retain talent has never been wider—making it more difficult than ever to choose. RSM takes the guesswork out of selecting and managing the right ones for your business’s needs.

The Inflation Reduction Act of 2022 (IRA) made a once-in-a-generation investment to incentivize clean energy projects and create energy-related jobs through the introduction, modification and expansion of tax credits and incentives.

The IRA substantially modified the existing credit available under Internal Revenue Code section 48. A component of the investment tax credit, the energy credit provides certain taxpayers and tax-exempt entities that invest in qualified energy property an opportunity to take advantage of these incentives. The IRA also introduced monetization rules that allow for the transfer of certain credits for cash, an exciting development for financing clean energy projects.

Taxpayers placing energy property in service in 2024 should consider energy credit opportunities under the IRA, which enables many solar power system components, battery storage devices, geothermal heat pumps and other energy property to qualify for a section 48 investment tax credit. A taxpayer may be able to claim a credit for up to 50% of qualifying capital expenditures if certain requirements are met.

For property placed in service after 2024, the section 48 investment tax credit will be replaced by the section 48E clean electricity investment tax credit.

The credit framework of section 48E is similar to that of section 48; however, it is technology-neutral, meaning that taxpayers will not need to invest in specific technologies to qualify. Instead, the property will need to produce electricity for which the greenhouse gas (GHG) emissions rate is zero or less. Section 48E is scheduled to sunset the later of 2032 or when certain GHG emissions rates are reached.

To understand how to take advantage of the credit, do the following:

Taxpayers may elect to buy certain clean energy tax credits from an unrelated seller for cash under monetization rules added by the IRA.

Buyers of these credits may be businesses with taxable income that want to reduce federal income tax liability, reduce estimated tax payments or support sustainability initiatives. Individuals are also able to purchase credits—but because purchased tax credits are treated as passive activity, passive activity loss and credit limitations must be considered. Buyers may be able to purchase the credits at a discount without recognizing any increase in federal taxable income.

The purchase of the tax credit does require careful diligence, as the buyer may be subject to underpayment penalties and excessive credit transfer taxes in the event a portion, or all, of the purchased credit is disallowed by the IRS. Tax advisors can assist in mitigating these risks through proper due diligence.

Identify and capitalize on opportunities in the energy credits market by doing the following:

Explore clean energy incentives to maximize benefits and secure tax credits for your business.

Excise taxes are levied on specific goods and services—such as fuel, alcohol and tobacco—and can be overlooked during federal tax planning. Many excise tax credits are refundable and may provide cash opportunities. Reducing excise tax liability may also improve operational efficiency margins, as excise taxes are generally recorded as a cost of goods sold. Ensuring your company’s compliance with excise taxes will also help mitigate costly penalties and interest.

As your business activities evolve and legislation changes—particularly in industries like transportation, energy or manufacturing—excise tax opportunities and exposure may fluctuate. Staying informed of legislative updates, such as changes in environmental taxes or energy-related credits, is key to reducing risk. Dedicated planning can also uncover opportunities for reducing excise tax burdens, depending on your business activities.

Consider taking the following actions:

The IRS is prioritizing enforcement activity, with $24 billion of supplemental funding earmarked for it through fiscal year 2031. Examinations of large corporations, partnerships and high net worth individuals are a central theme. To administer more exams, the agency in the last fiscal year has significantly expanded its Large Business and International Division, which administers tax compliance activities for large companies and high net worth individuals. Taxpayers, regardless of their tax profile, can improve their audit readiness by maintaining detailed documentation and optimizing compliance processes.

To accurately select partnerships for examination, the IRS is using an artificial intelligence (AI) solution, which was developed through a collaboration of experts in data science and tax enforcement who have been working together to develop machine learning technology.

The AI tool will “identify potential compliance risk in the areas of partnership tax, general income tax and accounting, and international tax in a taxpayer segment that historically has been subject to limited examination coverage,” according to an IRS news release.

Issues of interest for the IRS in partnership examinations are:

In preparation for a potential IRS exam, partnerships should consider:

Exams of high net worth individuals are conducted by the IRS Global High Wealth Industry Group, which is made up of experienced IRS auditors and forensic accountants. They commonly start with examining an individual and spread to that individual’s related entities, including partnerships and S or C corporations. Exams conducted by the Global High Wealth Industry Group can last from 18 months to two years.

The following are common items that the IRS examines:

See our 2024 year-end tax planning guide for individuals for more detail on those IRS focus areas for high net worth individuals, as well as suggestions for how to document and support the activity reported on the tax return.

IRS exam coverage of corporations was at about 8.8% by the end of 2019. Current data is not available due to open statute or ongoing examinations for tax years 2020–2023. The agency wants to get to 22.6% by fiscal year 2026, which is much more in line with the 28% coverage rate it achieved in tax year 2010 and prior.

Issues of interest for the IRS in corporate examinations include:

Corporations should maintain exam readiness by:

In those efforts, a tax advisor can help a corporation:

The IRS is paying a lot of attention to the section 41 research and development tax credit. Although the agency announced in June 2024 that it would reduce the amount of information required for submitting new research credit claims, the IRS may still demand more information during examination.

Moreover, starting in January 2025, the IRS can treat research credit claims as invalid if they are submitted without the required information. The agency can reject them summarily without the right to appeal.

The IRS has been emboldened by some recent wins in court cases involving the section 41 credit. Some of the most notable rulings have underscored the importance of detailed project documentation and contract review.

Businesses that claim the research credit can take the following steps to build resilience in the event of an IRS exam:

The IRS continues to scrutinize employee retention credit (ERC) claims. In addition to conducting examinations of claims, the IRS is sending letters fully disallowing unpaid ERC claims without examinations. The agency plans to send letters recapturing ERC refunds that it determines were erroneous.

Taxpayers receiving any of these IRS notices should work with a tax professional to respond promptly. Looking forward, as the IRS hires and trains more revenue agents, particularly IRS employment tax specialists, more employment tax examinations may occur.

Taxpayers with employees should:

The IRS has enhanced taxpayer access by improving its online tools, which provide more ways to communicate and interact with the IRS.

Taxpayers are first required to verify their identity through ID.me, a third-party identity verification service used on various online platforms. ID.me provides a username and password to the user to verify their identity. This same ID.me account can be used to access services through other government agencies, such as the Social Security Administration and Veterans Affairs. Through ID.me, the taxpayer can access individual and business accounts.

Individual taxpayers can use online access to:

Business taxpayers are now able to access tax records online as well. The business accounts are limited but are useful to sole proprietors, partnerships and S corporations.

The IRS document upload tool (DUT) allows the taxpayer to respond to IRS notices electronically. DUT operates as a digital mailroom that sorts and routes the uploaded documents to the appropriate IRS location. Taxpayers will receive electronic confirmation on screen, but it is important to note that the confirmation cannot serve as legal confirmation of delivery or receipt.

DUT may also be used over the phone with certain IRS hotline representatives. The caller will need to obtain an access code from the IRS representative to utilize the tool in this manner.

RSM provides assistance with tax controversy, IRS, state and local audits, consults on dispute avoidance, and advises on planning solutions to mitigate risk of future tax controversies with federal and state taxing authorities.

In response to several natural disasters in 2024, the IRS has offered some deadline relief to affected taxpayers. Also, individual taxpayers may be afforded special consideration for deducting casualty losses.

The IRS has issued various disaster relief postponing deadlines for taxpayers in affected states and specific counties to file tax returns, make tax payments, and perform other time-sensitive acts.

Taxpayers in parts of Arkansas, Florida, Iowa, Kentucky, Mississippi, New Mexico, Oklahoma, Texas and West Virginia have until Nov. 1, 2024, to file their 2023 tax year returns and make estimated tax payments.

Taxpayers in all or parts of Connecticut, Florida, Illinois, Kentucky, Louisiana, Minnesota, Missouri, New York, Pennsylvania, Puerto Rico, South Dakota, Texas, Vermont, the Virgin Islands and Washington state have until Feb. 3, 2025, to file their 2023 tax year returns and make estimated tax payments.

Taxpayers affected by Hurricane Helene in all or parts of Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee and Virginia will have until May 1, 2025, to file their 2023 tax year returns and make estimated tax payments.

Some of the most immediate concerns in a natural disaster arise from physical damage to property. Taxpayers learn the extent of damage to their property and consult with insurers to understand the financial impacts. Affected taxpayers and their advisors should familiarize themselves with the rules for assessing losses associated with casualty events, and the options for early deductions or deferring gain.

As a general rule, business taxpayers are entitled to deduct losses when property is destroyed in a casualty event under section 165. The measure of the loss is generally the lesser of the diminution of value or the amount of the adjusted basis in the property. If property is totally destroyed and the value of the property is greater than that adjusted basis, the amount of the loss equals the taxpayer’s adjusted basis.

Taxpayers are only entitled to deduct losses that are not compensated by insurance or other proceeds, meaning taxpayers whose property is insured may be in a holding position that prevents them from taking a deduction until they know how much insurance they will receive.

Under the Tax Cuts and Jobs Act (TCJA), for years 2018 through 2025, individual taxpayers can only deduct casualty losses for properties in a federally declared disaster area as prescribed by the president of the United States. This is a basic requirement to be able to take any deduction, but taxpayers are still subject to other limits.

An individual taxpayer affected by a federally declared disaster is still subject to the TCJA limitations per section 165(h), which states that a net casualty loss is allowed only to the extent it exceeds 10% of adjusted gross income (AGI) and a $100 floor.

Although certain IRS articles and publications indicate that qualified disaster losses are not subject to the 10% AGI limitation, it is important to clarify that qualified disaster is a technical term; as of early October, the 2024 disasters had not been declared qualified disasters by Congress.

The difference in terminology is subtle, but a loss attributable to a federally declared disaster is not equivalent to a qualified disaster loss. The 10% AGI limitation is a statutory rule, which means only an act of Congress can make a disaster a qualified disaster with losses not subject to the 10% AGI limitation. The IRS does not have discretion to waive the statutory 10% AGI limitation.

When insurance proceeds (or fair market value awards in a condemnation) exceed basis, taxpayers may experience a casualty gain (i.e., an involuntary conversion).

Section 1033 allows taxpayers to defer this gain by purchasing replacement property that is similar or related in service or use to what was destroyed.

In a presidentially declared disaster, section 1033(h)(2) provides a special rule that treats any tangible property purchased for use in a taxpayer’s trade or business as qualified replacement property for any converted property that the taxpayer held for use in its trade or business or for investment. This means taxpayers have very broad latitude to choose what they want to purchase, even if it is completely different from the property that was lost.

Note that section 1033 is also available for personal use property, but the special rule does not apply to individuals, who must stick to property replacing what was destroyed.

We offer a host of resources to help organizations navigate each stage of disaster response from immediate response to business recovery and proactive defenses.

Source: RSM US LLP.

Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/services/business-tax/business-tax-planning-guide.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

A tax planning guide for individual income tax planning and family tax planning strategies at 2024 year-end moving into 2025.

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go.

Beaird Harris is thrilled to announce that we have been ranked as No. 32 in CNBC’s annual list of “Top 100 Financial Advisory Firms of…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.