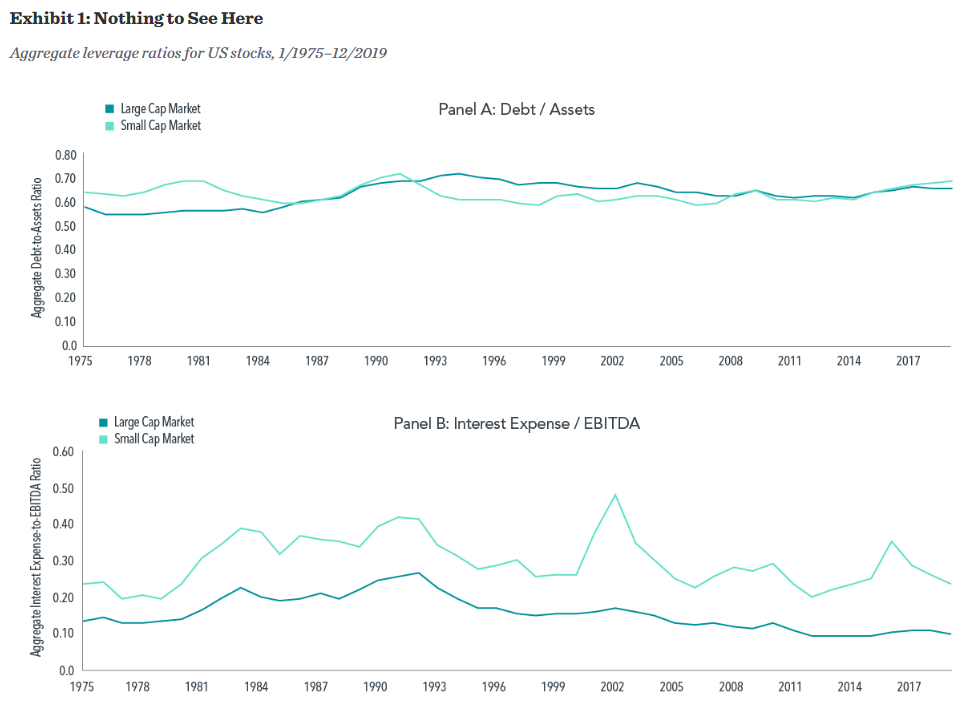

Figure 1 Source: Dimensional, using CRSP and Compustat. Characteristics evaluated for eligible US stocks, excluding financials, each July. Debt is current liabilities plus long-term debt plus other noncurrent liabilities (including deferred taxes, investment tax credit, and minority interest). EBITDA is earnings before interest, taxes, depreciation, and amortization. Large and small cap are defined as approximately the top 92% and bottom 8% of the market capitalization, respectively. Real estate investment trusts (REITs), tracking stocks, and investment companies are excluded from the universe. Past performance, including hypothetical performance, is no guarantee of future results.

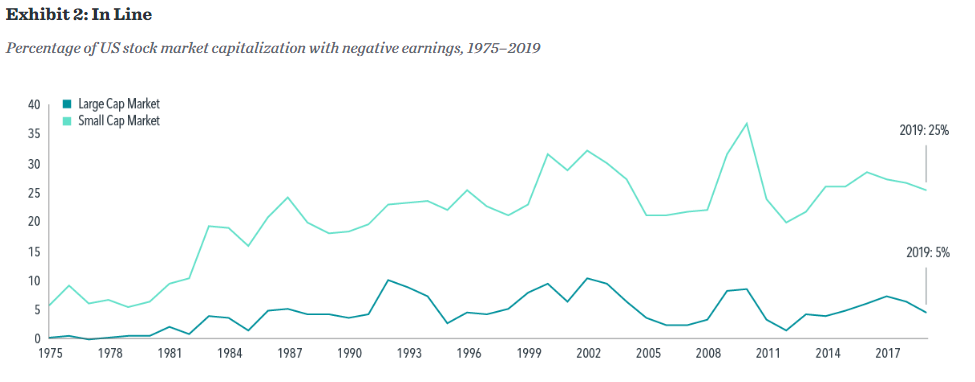

Figure 2 Source: Dimensional, using CRSP and Compustat. Earnings are defined as net income before extraordinary items. Characteristics evaluated for eligible US stocks at the end of each July. Large and small cap are defined as approximately the top 92% and bottom 8% of the market capitalization, respectively. REITs, tracking stocks, and investment companies are excluded from the universe. Past performance, including hypothetical performance, is no guarantee of future results.

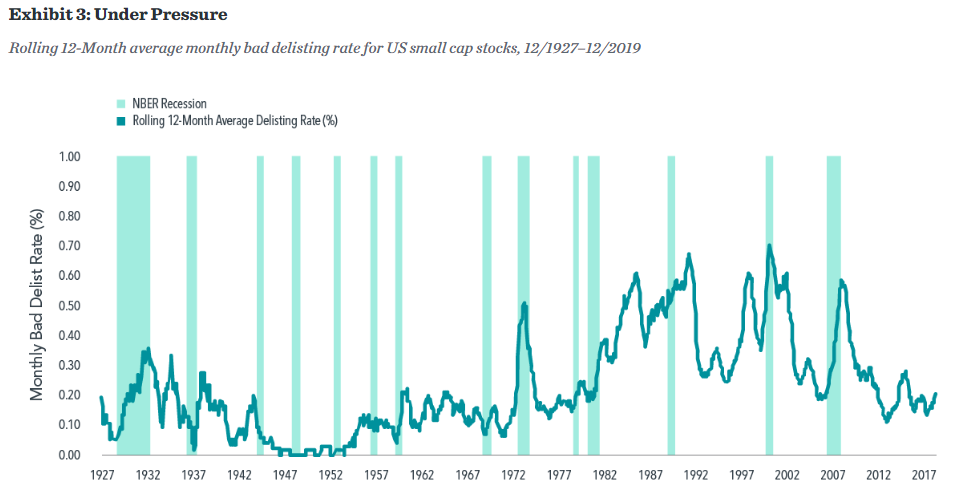

Figure 3 Source: Dimensional, using CRSP and Compustat. Shaded regions indicate months falling during recessions as designated by the National Bureau of Economic Research (NBER). Small caps are defined as approximately the bottom 8% of the market capitalization, rebalanced annually at the end of each June. The monthly delisting rate of a month between July of Year T and June of Year T+1 is the number of delisting in the month, divided by the number of names in the small cap universe in July of Year T. The one-year rolling delisting rate is computed as the average of the monthly delisting rates over 12 months. Bad delisting events are identified with those with the first digit of the delisting code four, five, or seven, which captures liquidations, delisting by the exchanges, and delisting by the SEC. A firm can be delisted by the exchanges for various reasons including bankruptcies and stock prices falling below the minimum requirement. The detailed description of delisting code is available at: crsp.org/products/documentation/data-definitions-d#delisting-code. Past performance, including hypothetical performance, is no guarantee of future results.

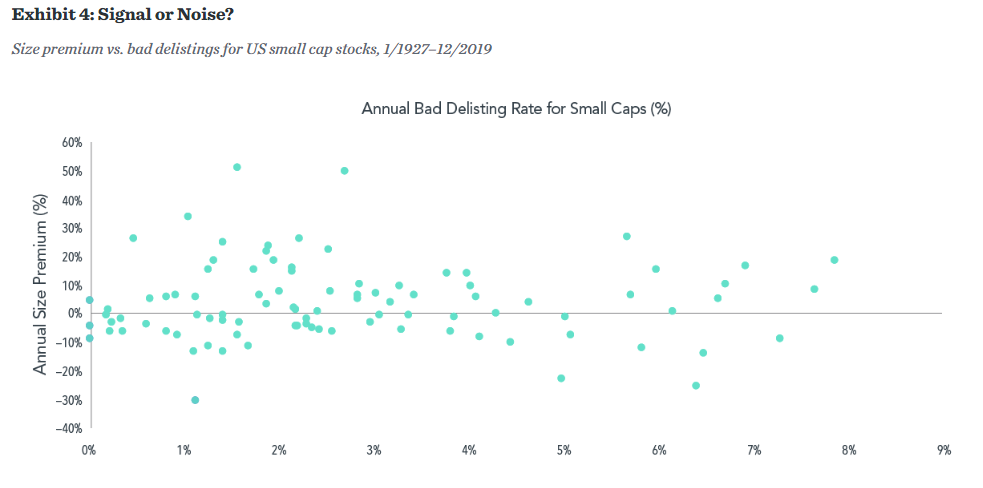

Figure 4 Source: Dimensional, using CRSP and Compustat. Shaded regions indicate months falling during recessions as designated by the National Bureau of Economic Research (NBER). Small caps are defined as approximately the bottom 8% of the market capitalization, rebalanced annually at the end of each June. The monthly delisting rate of a month between July of Year T and June of Year T+1 is the number of delisting in the month, divided by the number of names in the small cap universe in July of Year T. The annual delisting rate is computed as the sum of monthly delisting rates over each calendar year. Bad delisting events are identified with those with the first digit of the delisting code four, five, or seven, which captures liquidations, delisting by the exchanges, and delisting by the SEC. A firm can be delisted by the exchanges for various reasons including bankruptcies and stock prices falling below the minimum requirement. The detailed description of delisting code is available at: crsp.org/products/documentation/data-definitions-d#delisting-code. Size premium data provided by Ken French, available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

FOOTNOTES

1See Dai, Wei. 2016. “How Diversification Impacts the Reliability of Outcomes.” Dimensional Fund Advisors white paper, November 2016.

GLOSSARY

Small Cap: Refers to stocks with a relatively small market capitalization.

Large Cap: Refers to a company with a relatively large market capitalization.

Market Capitalization: The total market value of a company’s outstanding shares, computed as price times shares outstanding.

Size Premium: The return difference between small capitalization stocks and large capitalization stocks.

Leverage: Using borrowed money to increase the potential return of an investment.

Delisting: The removal of a listed security from a stock exchange.

DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

—

Adapted from Dimensional’s Can Small Cap Stocks Weather the Storm? The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.