Key Takeaways

- Recent conflict between Russia and Ukraine is an important reminder that geopolitical risk is a part of investing in the global markets.

- The conflict between Russia and Ukraine may contribute to increased short-term market volatility.

- Times of crisis require clear, succinct, core beliefs to navigate volatile situations and markets.

___________

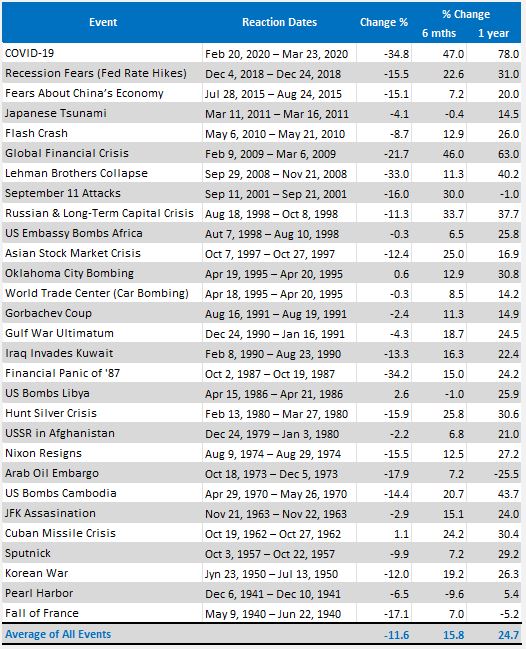

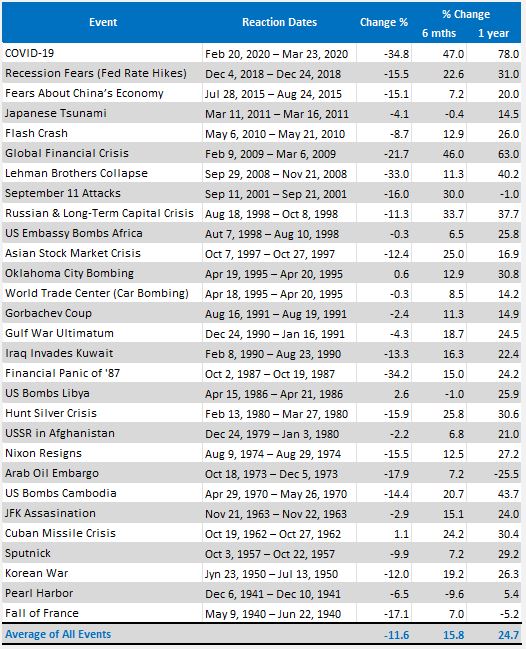

Crisis Events and the US Stock Market

The US stock market has experienced its share of crisis events—from wars to political upsets, to many unforeseen human tragedies. The table below highlights 29 crises that have occurred since 1940. During these events, the Dow Jones Industrial Average (DJIA) dropped by an average of about 11.6%. In all but three cases, the market returned to positive territory within six months of each decline, and the average return was about 25% after one year.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Global Developments and Their Impact

Geopolitical events like military or economic conflicts can affect stock markets in many ways. These events are generally widely followed by investors. We believe current market prices quickly incorporate expectations about the effects of these events on economies and companies. Our investment approach centers on using information in current market prices rather than trying to outguess them. We believe that the most effective way to mitigate the risk of unexpected events is through broad diversification and a disciplined investment process. This philosophy applies to other crises, like natural disasters, social unrest, and pandemics.

However, geopolitical events may sometimes lead to restrictions on investors’ ability to trade in specific stocks or on certain exchanges. One way is through government sanctions. In recent days, the US and other Western governments have issued sweeping new sanctions directed at Russia.

In another recent example, the US issued executive orders in 2020 and 2021 that prohibited US persons from investing in certain Chinese companies. Like the ongoing situation in Russia and Ukraine, this period was marked by uncertainty.

In some cases, geopolitical events have led to market closures, impacting all stocks in a certain market for a period of time. For example, on June 27, 2015, Greece closed its stock market after defaulting on its government debt. The Athens Stock Exchange stayed closed until August 3 of that year. During the Egyptian revolution of 2011, the Egyptian Stock Exchange closed after January 27 and remained closed for over a month. Unplanned market closures are not limited to emerging markets. In 2019, the Tokyo Stock Exchange closed for 10 days after Japanese Emperor Akihito abdicated the Chrysanthemum Throne. In 2001, the New York Stock Exchange closed until September 17 after the September 11 attacks on the World Trade Center.

These types of market events are not new, and the form that they take can vary. We’ve seen other examples over the decades during which we have managed portfolios, including currency repatriation restrictions in Malaysia in 1997, the introduction of capital controls in Argentina in 1999, and a successful coup d’état in Thailand that led to a market closure in 2006.

Negative events such as these may tempt investors to flee the financial markets. But diversification and a long-term perspective can help investors apply discipline to ride out the storm.