Tariffs, Turbulence and the Bigger Picture

An unbiased look at tariffs, national debt, and economic volatility—what it means, why it matters, and how long-term investors can stay grounded.

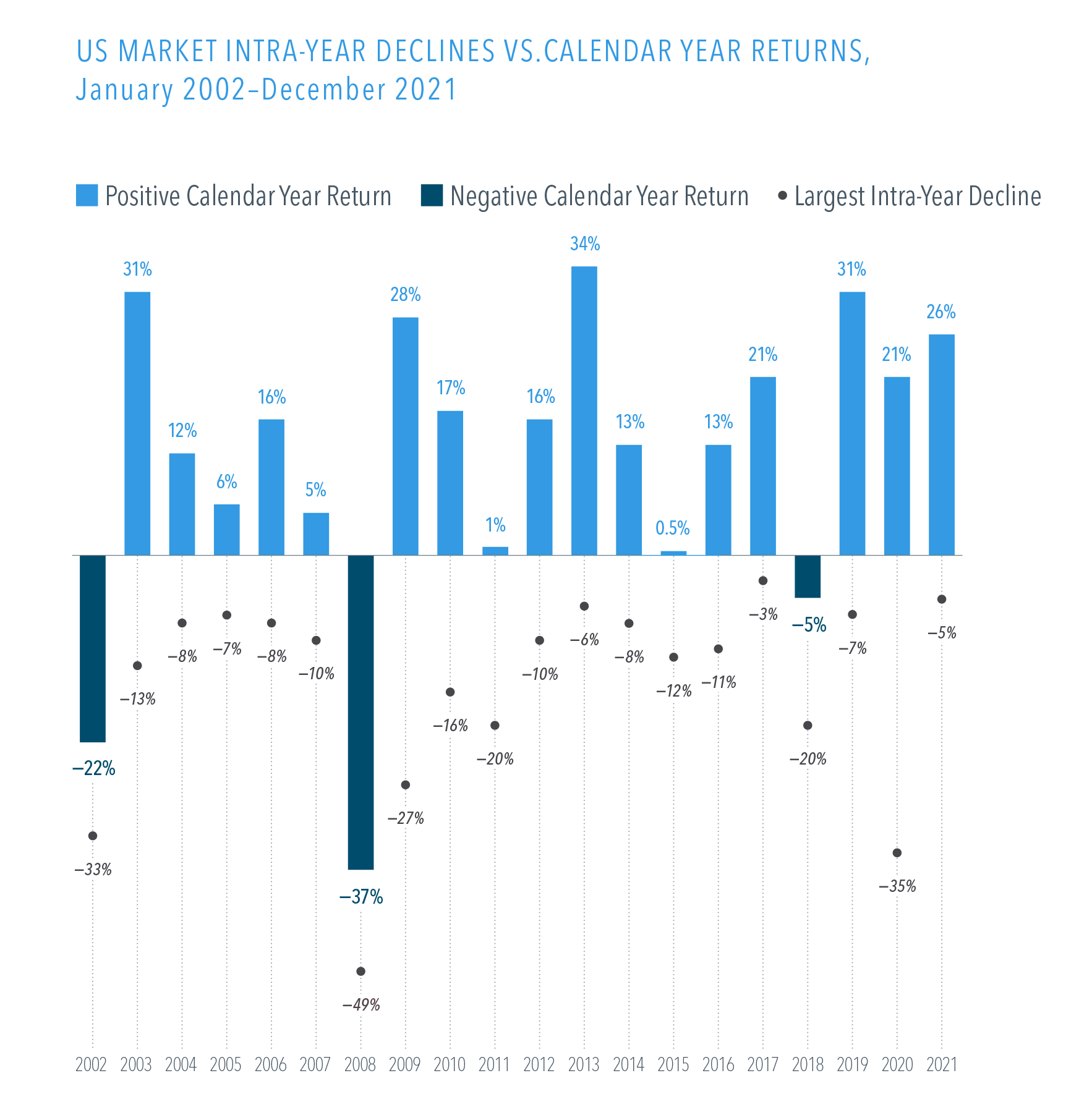

Stock market slides over a few days or months may lead investors to anticipate a down year. But a broad US market index had positive returns in 17 of the past 20 calendar years, despite some notable dips in many of those years. Even in 2020, when there were sharp market declines associated with the coronavirus pandemic, US stocks ended the year with gains of 21%.

Volatility is a normal part of investing. Tumbles may be scary, but they shouldn’t be surprising. A long-term focus can help investors keep perspective.

January 2002–December 2021, in US dollars. Data is calculated off rounded daily returns. US Market is represented by the Russell 3000 Index. Largest Intra-Year Decline refers to the largest market decrease from peak to trough during the year. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, LLC To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

An unbiased look at tariffs, national debt, and economic volatility—what it means, why it matters, and how long-term investors can stay grounded.

Dallas Business Journal lists Beaird Harris #39 in its 2025 list of North Texas Accounting Firm. Beaird Harris was named one of the largest North…

The Social Security Administration has announced it will start issuing retroactive payments and increasing monthly benefits for people affected by the Windfall Elimination Provision (WEP)…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.