Beaird Harris Among America’s Top Registered Investment Advisors

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

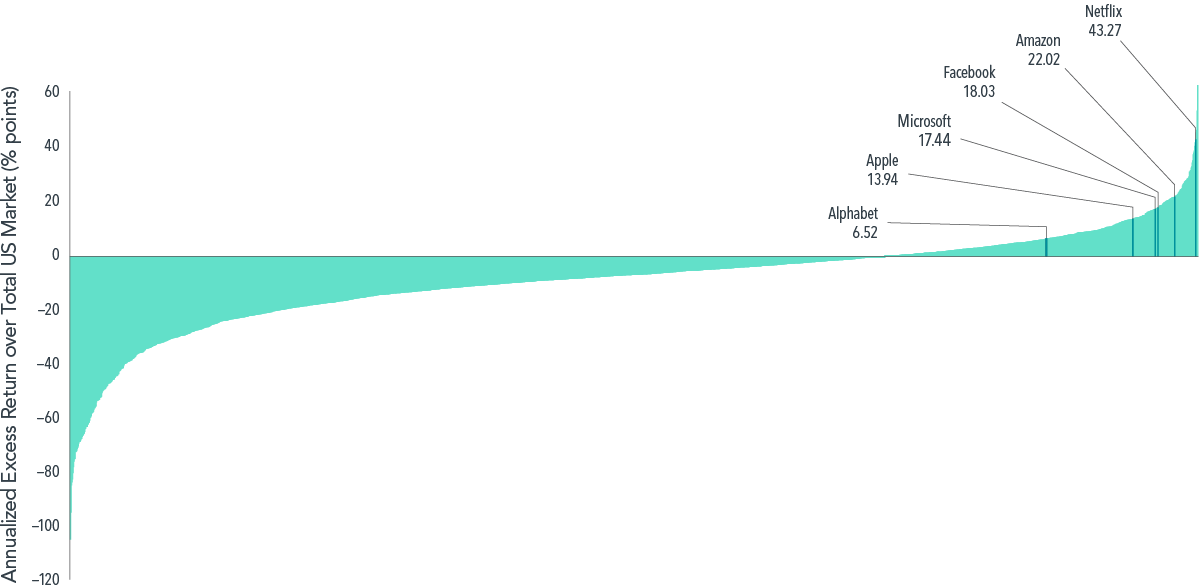

A handful of large technology stocks have garnered attention for outsize returns in recent years. Collectively referred to by the FANMAG acronym, Facebook, Amazon, Netflix, Microsoft, Apple, and Google (now trading as Alphabet) all substantially outperformed the US market1 in the eight calendar years that they have all been public companies (Facebook went public in May 2012).2 Emerging as winners from among a large number of companies that fared less well during 2013–2020,3 these juggernauts bested most of their surviving peers with annualized outperformance versus the US market ranging from 7.31 (Alphabet) to 42.58 percentage points (Netflix), as shown in Exhibit 1.

EXHIBIT 1

At the Top of Their Game

Annualized compound return in excess of US market, January 2013–November 2020

Past performance is no guarantee of future results. In USD. Data from CRSP and Compustat for time period January 2013–November 2020. US market is defined as Fama/French Total US Market Research Index. Annualized excess returns are computed for stocks that were available in January 2013 and survived the 95-month period ending in November 2020.

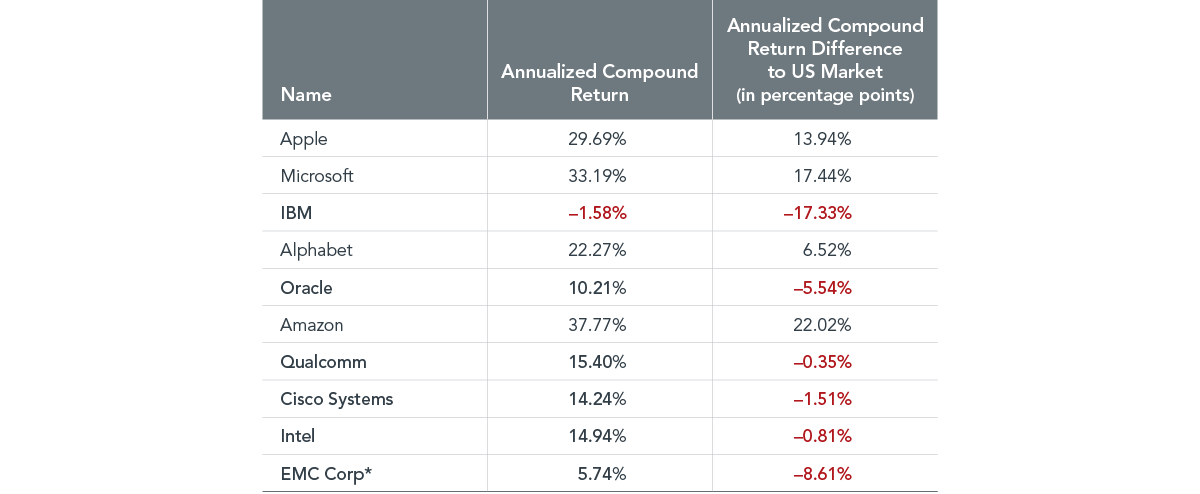

While this performance dazzled investors and dominated headlines during 2013–2020, a more complete picture emerges when accounting for the many companies whose investors were less fortunate over the period. As shown in Exhibit 2, of the 10 largest US technology stocks as of January 2013, all but Apple, Microsoft, Alphabet, and Amazon underperformed the US market over the same period that elevated their tech peers to financial market stardom.

EXHIBIT 2

Same Game, Different Outcome

Performance of the 10 largest US technology stocks as of January 2013 from January 2013 to November 2020

Past performance is no guarantee of future results. In USD. *EMC Corp. return covers the period from January 2013 until the firm’s delisting in September 2016. Data from CRSP and Compustat for time period 2013–November 2020. US market is defined as Fama/French Total US Market Research Index. Companies ranked by beginning-of-period market capitalization from largest to smallest. Technology stocks identified using the Fama/French 10 Industry High-Tech Sector.

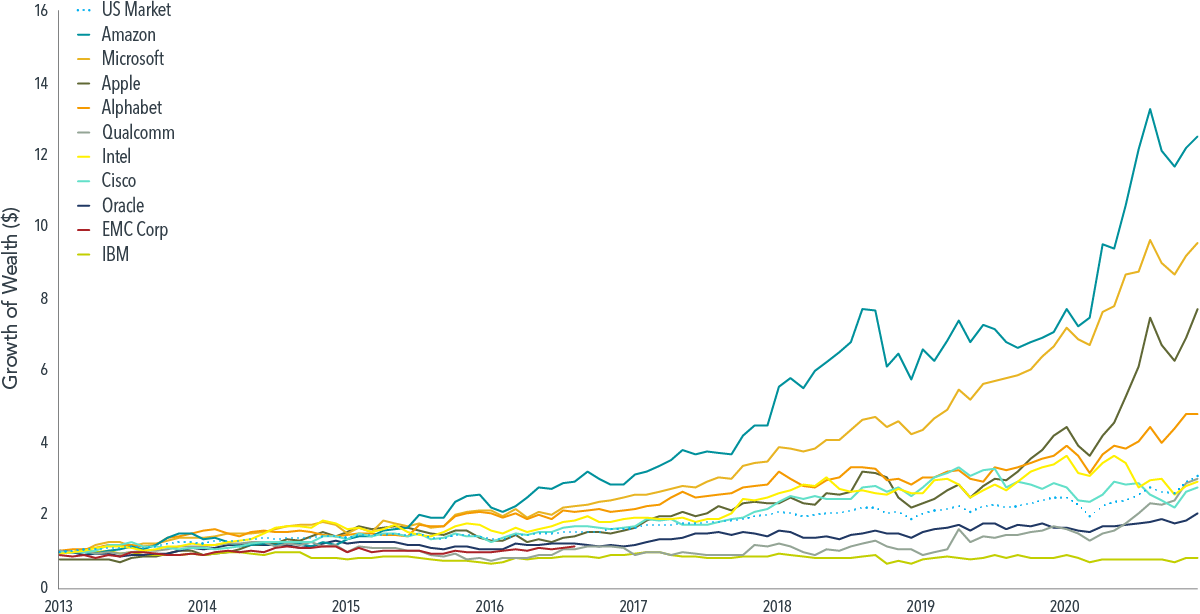

Exhibit 3 shows the hypothetical growth of wealth for an investor who put $1 in each of the 10 largest technology stocks and the US market in January 2013. While the $1 invested in Amazon and Apple, for example, would have grown to $12.63 and $7.18, respectively, by November 2020, the returns of their non-FANMAG tech contemporaries would have failed to even surpass the US market.

EXHIBIT 3

Growth of Wealth

Growth of wealth for 10 largest US technology stocks as of January 2013 and US market, January 2013–November 2020

Past performance, including hypothetical performance, is no guarantee of future results. In USD. Data from CRSP and Compustat for time period January 2013–November 2020. Performance includes reinvestment of dividends and capital gains. Data presented in the Growth of $1 chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. US market is defined as Fama/French Total US Market Research Index.

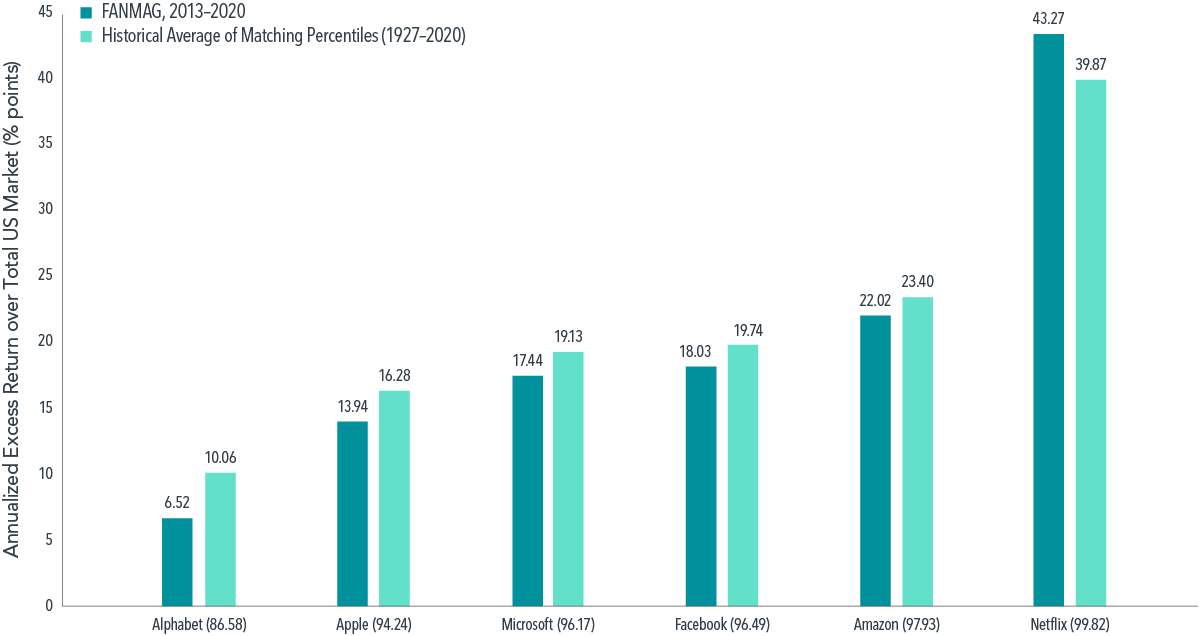

FANMAG returns certainly stand out among those of their contemporaries, but the range of individual stock outcomes has often been immense. A historical look shows that FANMAG performance has been quite ordinary in the context of past top-of-the-market performers. Drawing on stock return data since 1927, Exhibit 4 indicates that historical top performers often experienced larger outperformance relative to the US market than the FANMAG stocks realized during 2013–2020. For example, Apple’s 2013–2020 annualized excess return of 13.00 percentage points places it at the 93.67 return percentile among all US stocks that were trading in January 2013 and survived the eight-year period that followed. However, the average outperformance of stocks at the 93.67 percentile over eight-year rolling periods from 1927 to 2020 was 15.60 percentage points, or about 2.60 percentage points higher. With the exception of Netflix, the same holds for the other FANMAG stocks, with historical outperformers at the same return percentile outperforming the market by more than the FANMAG stocks did in 2013–2020.

EXHIBIT 4

A Familiar Tale for the Right Tail

FANMAG outperformance vs. US market, 2013–2020, compared to average historical outperformance of stocks at same return distribution percentile over rolling eight-year periods, 1927–2020

Past performance is no guarantee of future results. In USD. Data from CRSP and Compustat for time period 1927–November 2020. US market defined as Fama/French Total US Market Research Index. Next to each FANMAG stock in parenthesis is its corresponding percentile rank of annualized returns excess of the market between January 2013 and November 2020, computed from among stocks that survived the 95-month period.

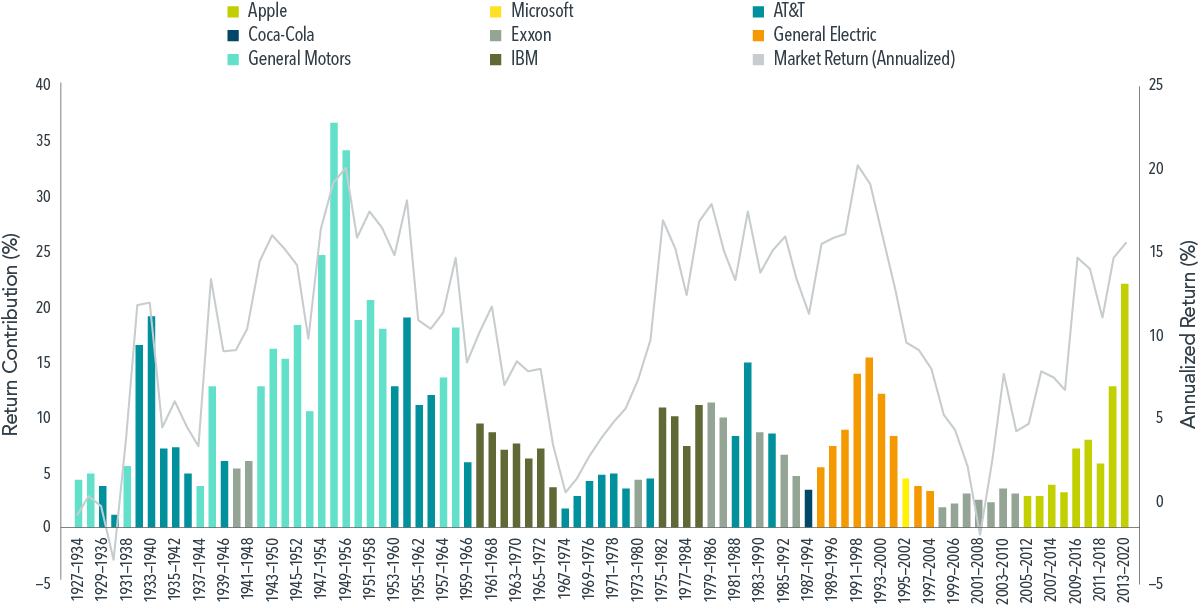

A defining trait of the FANMAG performance is that these outsize returns have come from among the largest companies in the US, implying they were meaningful contributors to the overall US market’s return. However, historical data show that this too is nothing new. Defining a stock’s return contribution as its total return weighted by its beginning-of-period market capitalization weight, we see that Apple’s contribution to the US market for the period 2013–2020 was 19.68%. How does this figure compare to other top return contributors? Exhibit 5 illustrates the top return contribution and the annualized US market return over rolling eight-year periods since 1927, revealing instances of return contributions by the likes of AT&T, General Motors, and General Electric that were comparable to, or even exceeded, that of Apple in 2013–2020.

EXHIBIT 5

Key Contributors

Past performance is no guarantee of future results. In USD. Data from CRSP and Compustat for time period 1927–November 2020. A stock’s return contribution is defined as its total cumulative return over eight years weighted by its beginning-of-period market capitalization weight. Each bar represents the top return contributing stock, and the solid black line shows the annualized US market return over rolling eight-year windows. US market defined as Fama/French Total US Market Research Index.

If history is any guide, the FANMAG acronym will eventually be replaced by another trendy name. For example, stock market historians will remember the Nifty Fifty in the 1960s and 70s, a set of 50 blue-chip stocks like Coca-Cola and General Electric. The early 2000s witnessed increasing adoption of the acronym BRIC, representing investment opportunities in the fast-growing emerging economies of Brazil, Russia, India, and China. More recently, the WATCH companies—Walmart, Amazon, Target, Costco, and Home Depot—have also gained traction in the market’s lexicon.

While documenting trends in finance is entertaining, there is little evidence that investors can spot these trends in advance in a way that would enable market-beating performance. Moreover, concentrated bets on high-flying stocks can expose investors to idiosyncratic risks and a wider range of possible outcomes. By contrast, a sound investment approach based on financial science emphasizes the importance of broadly diversified portfolios that provide exposure to a vast array of companies and sectors to help manage risks, increase flexibility in implementation, and increase the reliability of outcomes.

FOOTNOTES

1US market is defined as Fama/French Total US Market Research Index.

2Facebook, Amazon, Apple, Netflix, and Google are often referred to as the FAANG stocks.

3Calendar year 2020 data is updated only through November 2020.

GLOSSARY

Fama/French Total US Market Research Index: The value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

Results shown during periods prior to each index’s index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Named securities may be held in accounts managed by Dimensional. This information should not be considered a recommendation to buy or sell a particular security.

—

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

—

Adapted from Dimensional’s FANMAG: Because FAANGs Are So Yesterday

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

In times of high inflation, managing lifestyle creep is crucial to maintaining financial stability and achieving long-term financial goals.

Whether you’ve been investing for decades or are just getting started, at some point you’ll likely ask yourself some fundamental questions. The 10 listed here…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.