Beaird Harris Among America’s Top Registered Investment Advisors

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

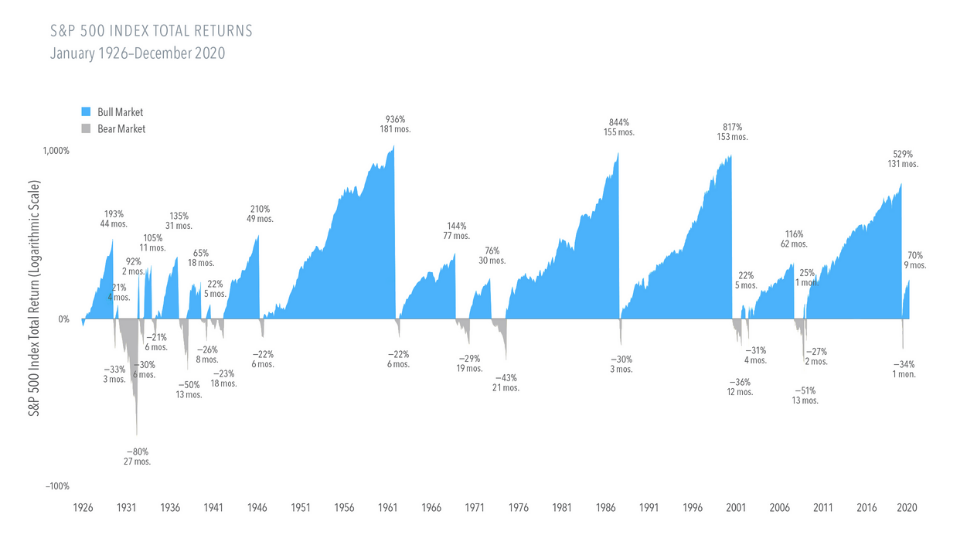

The stock market’s ups and downs are unpredictable, but history supports an expectation of positive returns over the long-term. For the best shot at the benefits the market can offer, stay the course.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

In USD. Chart end date is December 31, 2020, the last trough to peak return of 70% represents the return through December 2020. Due to availability of data, monthly returns are used January 1926 through December 1989; daily returns are used January 1990 through present. Periods in which cumulative return from peak is –20% or lower and a recovery of 20% from trough has not yet occurred are considered Bear markets. Bull markets are subsequent rises following the bear market trough through the next recovery of at least 20%. The chart shows bear markets and bull markets, the number of months they lasted and the associated cumulative performance for each market period. Results for different time periods could differ from the results shown. A logarithmic scale is a nonlinear scale in which the numbers shown are a set distance along the axis and the increments are a power, or logarithm, of a base number. This allows data over a wide range of values to be displayed in a condensed way.

Source: S&P data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

In times of high inflation, managing lifestyle creep is crucial to maintaining financial stability and achieving long-term financial goals.

Whether you’ve been investing for decades or are just getting started, at some point you’ll likely ask yourself some fundamental questions. The 10 listed here…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.