Beaird Harris Among America’s Top Registered Investment Advisors

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

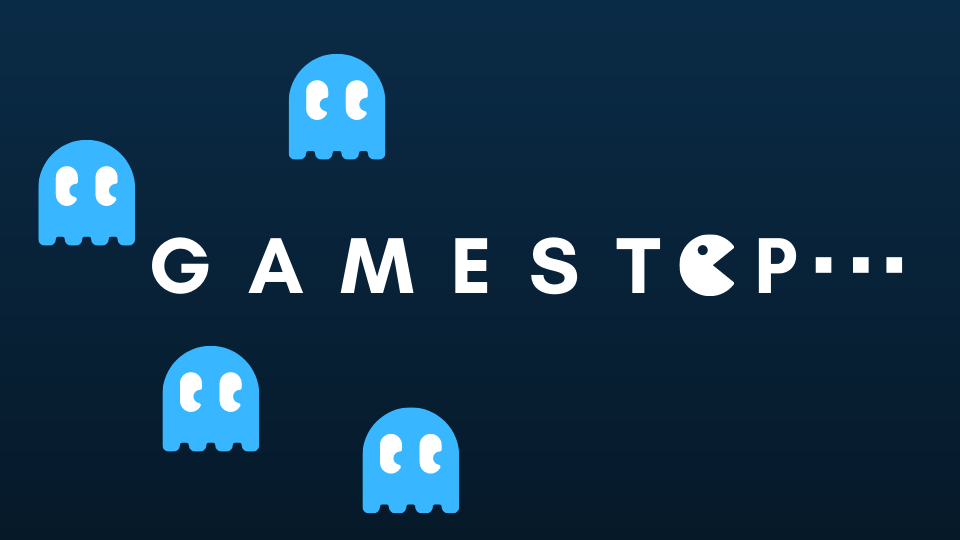

A recent flurry of return spikes for a handful of US stocks has captivated investors and noninvestors alike. Wall Street news trending on social media even amid an NFL playoff season is indeed an unusual event.

So, what should investors make of these dramatic price movements? A good place to start is with prices themselves. Prices reflect discount rates applied to the expected future cash flows of companies. One can interpret these discount rates as the expected return demanded in aggregate by market participants to hold shares of a company.

Discount rates for a stock incorporate a potentially massive number of viewpoints about the company. Equity markets processed over $653.4 billion worth of trades on an average day in 2020. The result of such activity is prices reacting to a vast amount of information relevant to discount rates.

The link between prices and expected future cash flows through discount rates gives us a framework for interpreting changes in prices. If a stock’s price goes up, either expectations of cash flows have gone up or the discount rate went down. In the case of the latter, a stock price moving higher means lower expected returns.

Aggregate demand for securities, and therefore discount rates, can be driven by many variables. Investors may assess a company’s exposure to myriad risks, such as sensitivity to macroeconomic variables (inflation, interest rate changes, GDP growth, etc.), its volatility, and susceptibility to regulatory changes, just to name a few. The riskier the investment, the higher the discount rate.

But investor tastes and preferences also play a role in setting discount rates for securities. If market participants prefer one company over another, the rate of return demanded to hold that company’s stock may be lower than another stock for that reason alone. This effect is analogous to color preferences of car buyers; if enough shoppers are averse to primary colors, you may be able to get a relative discount on that new, bright-yellow car!

Nearly a century of empirical data tells us that we can use market prices to systematically identify stocks with higher expected returns. This approach is indifferent to the specific considerations driving differences in discount rates. And the evidence for relying on market prices spans a history of different economic environments, market infrastructure evolution, and regulatory changes.

What hasn’t generally benefited investors is attempting to outguess markets and identify mispriced securities. The degree of difficulty in anticipating market movements more quickly and effectively than the millions of other market participants is consistent with the paucity of professional investment managers that have been able to outperform passive benchmarks. For investors, this means time is probably better spent scrolling past the news on stock price spikes and going back to arguing about who will win the Super Bowl.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

—

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

—

Adapted from Dimensional’s What History Tells Us About US Presidential Elections and the Market

Beaird Harris has been ranked as one of Financial Advisor Magazine’s 2024 America’s Top RIAs!

In times of high inflation, managing lifestyle creep is crucial to maintaining financial stability and achieving long-term financial goals.

Whether you’ve been investing for decades or are just getting started, at some point you’ll likely ask yourself some fundamental questions. The 10 listed here…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.