Presidential Elections: What Do They Mean for Markets?

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go.

If ongoing debate over the debt ceiling is giving you a dizzying sense of déjà vu, you are forgiven. The debt ceiling, or limit, reflects the amount of money the United States (US) Congress has authorized the government to borrow, and Congress can authorize increases when the government nears or reaches the existing limit. According to the US Treasury Department, Congress has acted to effectively raise the debt ceiling 78 distinct times since 1960.1 Occasionally, policymakers have struggled to reach consensus to authorize increases.

The US effectively reached the debt limit in January, triggering “extraordinary measures” by the Treasury Department to allow continued servicing of existing debts and obligations. But Treasury Secretary Janet Yellen has issued a warning that the “X-date,” when these extraordinary measures may be exhausted, could come as soon as June 1.2 As the X-date approaches without a political consensus to raise the debt limit, many investors are wondering how a breach of the debt ceiling could impact their investments.

While debt ceiling debates can be nerve-racking, the implications for investors are uncertain. Historically, Congress has always raised the debt limit, and even if Congress failed to increase the limit in time, it is not clear what that would mean in practical terms. A range of payments could be impacted, from salary payments for federal workers to interest and principal payments on federal debt. But trying to predict likely scenarios is largely unproductive, given that markets have priced in the potential range of outcomes. Sticking to a sound investment plan that is designed to achieve long-term goals can help investors see beyond the current turmoil.

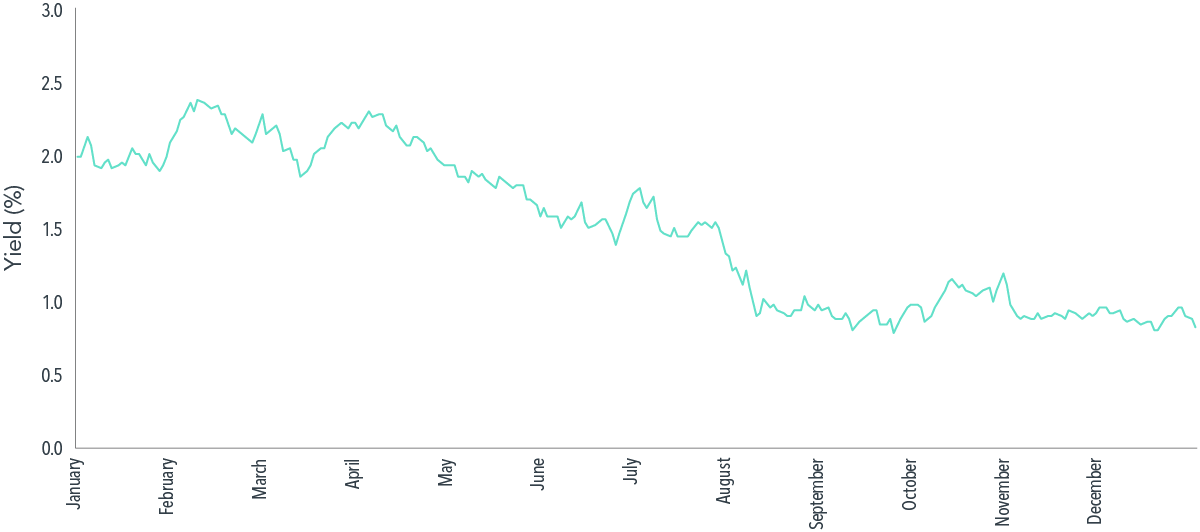

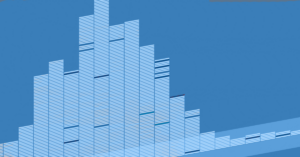

As the X-date nears without a clear path to political resolution, we may observe reactions and heightened volatility in both the equity and fixed income markets. The debt limit negotiations are one of many factors that impact security prices. In the debt ceiling crisis of 2011, US Treasury yields declined during the period surrounding the culmination of the tense negotiations that resolved in August (see Exhibit 1), despite S&P downgrading the credit rating on US sovereign debt from AAA to AA+.3

EXHIBIT 1

Falling Yield

Market volatility is part of investing. Facing uncertainty is a prerequisite to earning risk premiums, and times of heightened uncertainty can often bring heightened volatility. Planning for uncertainty with a flexible and adaptive investment process can help you navigate volatile market environments while staying focused on your goals. Reacting to short-term uncertainty may be a quick way to derail progress toward long-term goals.

An investment approach with built-in flexibility enables portfolio managers to adapt to changes in market prices or credit spreads in real time. It also allows for sensible ongoing portfolio management to potentially avoid unnecessary trading during times of heightened volatility. Certain types of investment strategies, like traditional indexing, may face constraints that limit their flexibility due to having to closely track an index regardless of current market conditions.

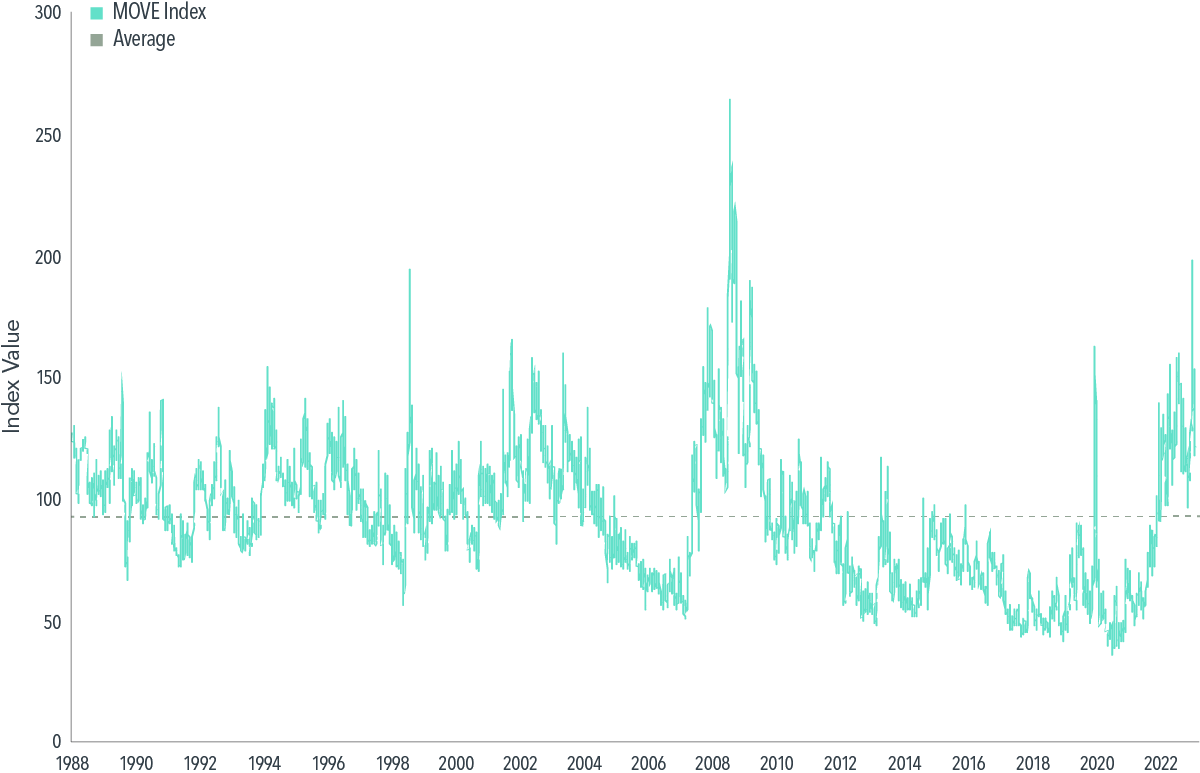

Designing investment portfolios and processes with flexibility can help give portfolio managers and traders additional tools to sensibly manage ongoing risks, potentially reduce costs, and maintain a focus on higher expected returns even during times of heightened market volatility. This year, measures of interest rate volatility on US Treasury securities have been elevated (see Exhibit 2), though these levels are influenced by a range of factors, including expectations for the federal funds rate.

EXHIBIT 2

Interesting Times

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

When investors face uncertainty, diversification remains one of the most important risk management tools available to them. Although a US government technical default likely would trigger reverberations throughout global markets, we believe a balanced asset allocation of global equity and fixed income investments combined with a long-term investment horizon are the best tools investors can use to help ride out short-term and close-to-home uncertainty.

DISCLOSURES

Adapted from Mind over Matter: Perspective for Investors on the US Debt Ceiling by Dimensional Fund Advisors LP

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 Index. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, LLC To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go.

Beaird Harris is thrilled to announce that we have been ranked as No. 32 in CNBC’s annual list of “Top 100 Financial Advisory Firms of…

As you consider your year-end charitable giving strategies – whether you want to support your favorite qualified charity or make an annual gift to your…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.