Presidential Elections: What Do They Mean for Markets?

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go.

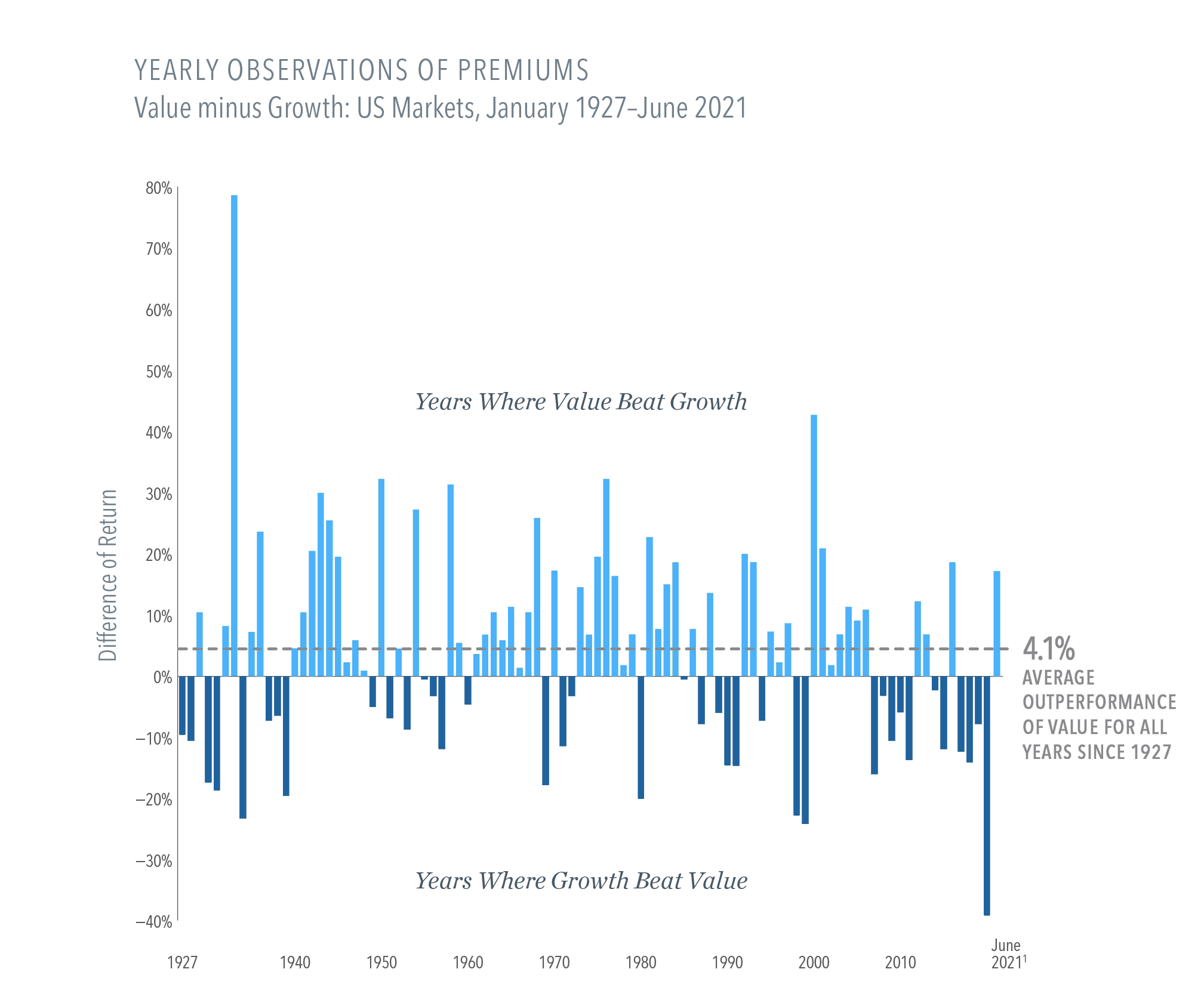

Logic and history argue for a commitment to value stocks, so investors can be positioned to take part when those shares outperform in the future.

Adapted from When It’s Value vs. Growth, History Is on Value’s Side by Dimensional Fund Advisors LP. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, Inc.), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris Wealth Management, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, Inc. is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, Inc.’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

—

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. Yearly premiums are calculated as the difference in one-year returns between the two indices described. Value minus growth: Fama/French US Value Research Index minus the Fama/French US Growth Research Index. Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973). Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973). Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go.

Beaird Harris is thrilled to announce that we have been ranked as No. 32 in CNBC’s annual list of “Top 100 Financial Advisory Firms of…

As you consider your year-end charitable giving strategies – whether you want to support your favorite qualified charity or make an annual gift to your…

Schedule a complimentary call today. We’ll help you get started and learn more about Beaird Harris.